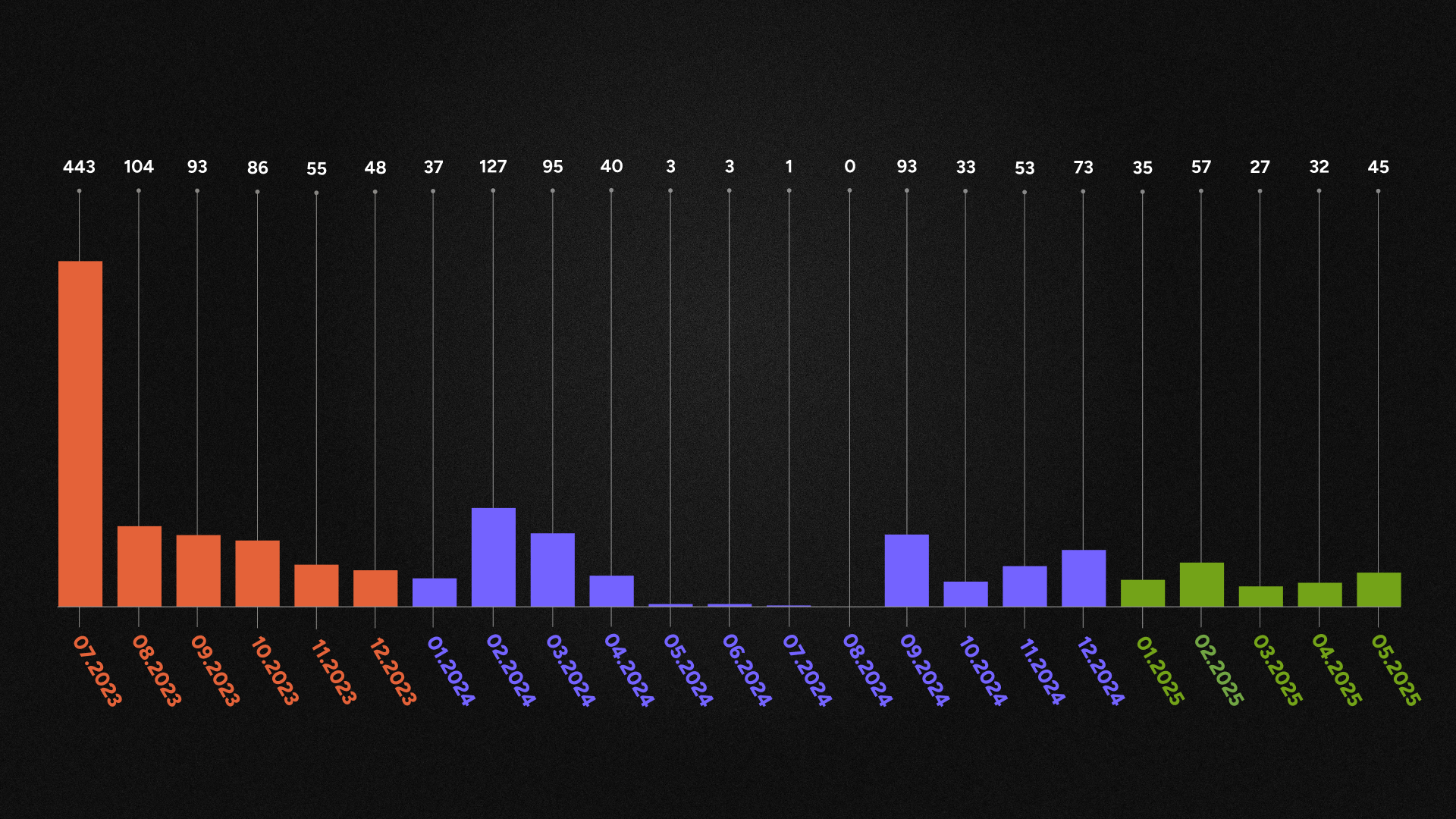

July emerges as HelloFresh's peak promotional month with 443 total promo codes in 2023, revealing strategic emphasis on summer meal planning

February shows consistent strength with 127 promotional codes in 2024, suggesting a Valentine's Day and winter comfort food marketing push

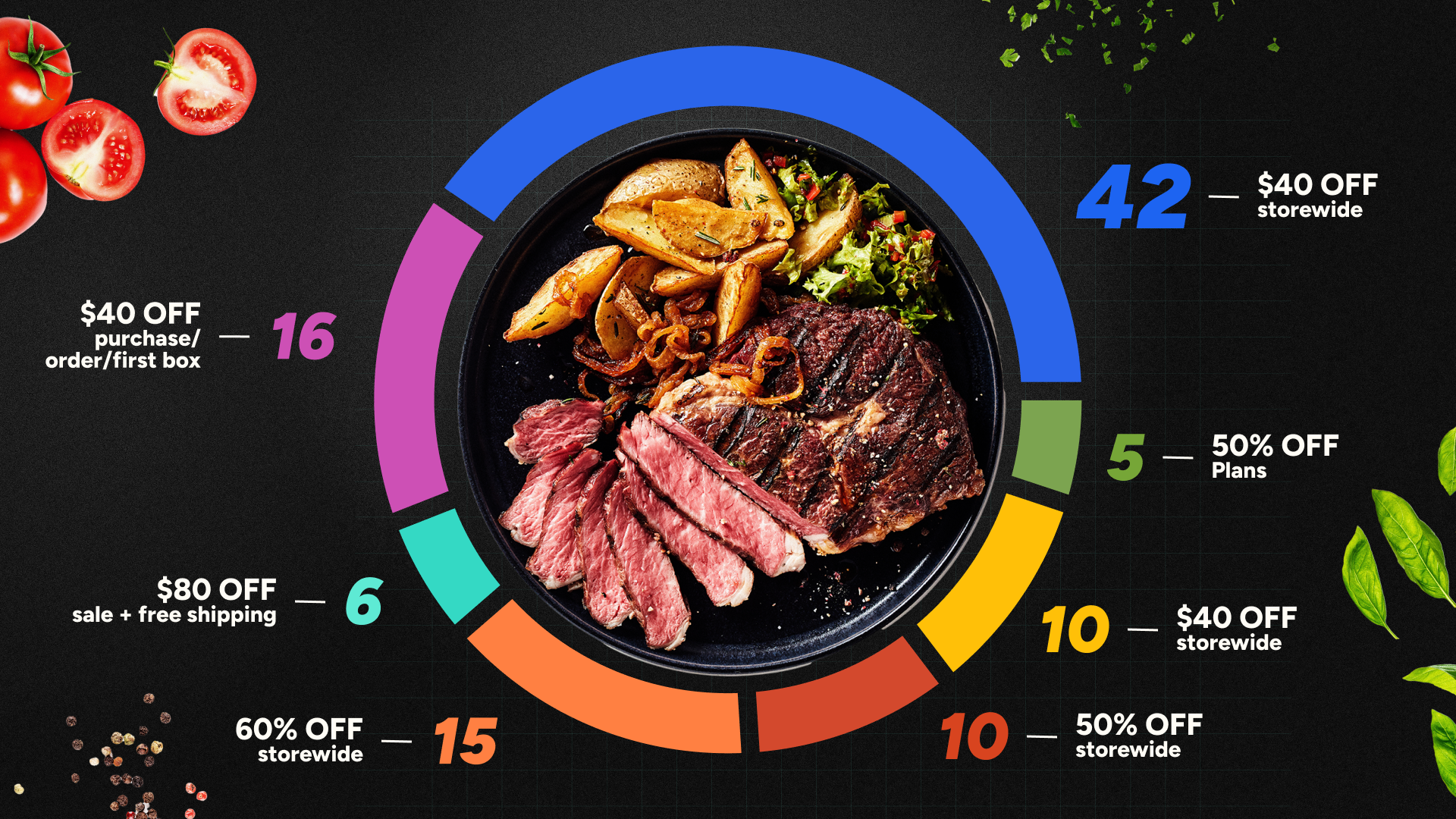

$40 off storewide dominates as HelloFresh's most frequent promotion, appearing 42 times in our dataset

Data reveals 60% off storewide as HelloFresh's second most common high-value discount, offered 15 times across analyzed periods

Strategic timing can save consumers up to 70% on meal subscriptions through HelloFresh's predictable promotional calendar

Understanding HelloFresh's promotional patterns can transform your meal kit shopping strategy. SimplyCodes' analysis of over 1,500 HelloFresh promo codes reveals clear seasonal trends, evolving discount strategies, and opportunities for significant meal subscription savings that savvy shoppers can leverage in 2025 and beyond. As the table above shows, HelloFresh's promotional activity varies dramatically throughout the year, with July 2023's remarkable 443 promo codes representing their most aggressive promotional period on record.

Can't get enough HelloFresh? Check out the HelloFresh promo codes so you never miss a deal

HelloFresh promotional evolution: A 2-year perspective

HelloFresh's approach to promotions has evolved significantly since 2023, reflecting both the company's growth and changing subscription meal kit trends. Our analysis of promotional codes released between July 2023 and May 2025 reveals valuable insights into their promotional strategy.

Month | Promo codes | Month | Promo codes |

July 2023 | 443 | August 2024 | 0 |

August 2023 | 104 | September 2024 | 93 |

September 2023 | 93 | October 2024 | 33 |

October 2023 | 86 | November 2024 | 53 |

November 2023 | 55 | December 2024 | 73 |

December 2023 | 48 | January 2025 | 35 |

January 2024 | 37 | February 2025 | 57 |

February 2024 | 127 | March 2025 | 27 |

March 2024 | 95 | April 2025 | 32 |

April 2024 | 40 | May 2025 | 45 |

May 2024 | 3 | ||

June 2024 | 3 | ||

July 2024 | 1 |

From volume to strategic precision: The shift in discount approach

One of the most striking findings is HelloFresh's dramatic shift in promotional volume. In July 2023, HelloFresh released an extraordinary 443 promotional codes—a number that has not been matched since. This represents a fundamental change in their marketing approach:

2023 strategy: High-volume promotional releases with 443 codes in July alone

2024 strategy: More measured approach with peaks of 127 codes in February

2025 strategy: Increasing strategic precision with targeted monthly releases

This evolution suggests HelloFresh is refining its approach to customer acquisition, moving from broad-based discount saturation to more strategic, timed promotions that align with specific seasonal opportunities and customer acquisition goals.

Code value consistency amid changing strategy

Despite shifts in volume, HelloFresh has maintained remarkable consistency in their core promotional offerings:

$40 off storewide remains their flagship promotion, appearing 42 times

60% off storewide emerges as their most aggressive percentage discount, used 15 times

Up to $143 off storewide represents their highest dollar-value offer, appearing 8 times

This consistency amid changing promotional volume suggests HelloFresh has identified optimal discount thresholds that balance customer acquisition with sustainable unit economics.

Want to learn more on how to save with HelloFesh? Read 6 HelloFresh hacks to always have a discount

Seasonal patterns in HelloFresh promotions

Courtesy of HelloFresh

Courtesy of HelloFreshTwo years of data reveal clear seasonal patterns in HelloFresh's promotional calendar, with certain months consistently showing stronger promotional activity.

July: HelloFresh's promotional powerhouse

July stands out as HelloFresh's most promotion-heavy month with 443 promo codes released in 2023. This concentration likely aligns with several strategic factors:

Summer cooking fatigue when consumers seek convenient meal solutions

Mid-year customer acquisition push before Q3/Q4 planning

Counter-programming against summer travel season when cooking routines are disrupted

The extraordinary volume in July 2023 (443 codes) suggests a particularly aggressive mid-year customer acquisition campaign, potentially tied to competitive pressures or ambitious growth targets.

February: Valentine's and comfort food marketing

February emerges as another promotional stronghold, with 127 codes released in February 2024. This seasonal spike correlates with:

Valentine's Day marketing opportunities

Winter comfort food messaging

New Year's resolution follow-through period when meal planning momentum may wane

The February promotional emphasis has continued in 2025, with 57 codes representing a significant focus during this key winter period.

Autumn revival: September consistency

September shows remarkable consistency across years with exactly 93 promotional codes in both 2023 and 2024. This consistent focus suggests HelloFresh has identified September as a critical customer acquisition period, likely tied to:

Back-to-school schedule shifts creating new meal planning challenges

Post-summer routine reestablishment

Pre-holiday promotional positioning

This September consistency indicates a carefully calibrated approach to fall marketing that has proven effective enough to replicate precisely year over year.

Quieter periods: Promotional gaps

The data also identifies periods of minimal promotional activity:

May-August 2024 shows a dramatic decline, with just 7 total codes across 4 months

December consistently shows moderate activity (48 codes in 2023, 73 in 2024)

Current data suggests a potential decline in early 2025 promotion volume

These gaps in the promotional calendar may represent strategic pauses in HelloFresh's discount strategy, potentially to maintain margins during key retail periods or to create greater impact for their major promotional events in July and February.

HelloFresh discount strategies through the years

The multi-year dataset reveals distinct patterns in how HelloFresh structures its meal kit discounts and how these approaches have evolved over time.

2023: Establishing massive promotional volume

2023 shows extraordinary promotional activity, with several key patterns:

July 2023: 443 promotional codes representing an unprecedented promotional push

August-December 2023: Gradual but steady decline from 104 codes to 48 codes

Consistent emphasis on storewide discounts throughout the period

This high-volume approach suggests an aggressive customer acquisition strategy, potentially aimed at establishing market dominance or countering competitive threats.

2024: Cyclical promotion rhythm

2024 reveals a more cyclical approach to promotions:

February 2024: 127 promotional codes, establishing a new peak

April 2024: Sharp decline to 40 codes

May-July 2024: Dramatic reduction to just 7 total codes across three months

September 2024: Sudden return to 93 codes, matching exactly the September 2023 figure

December 2024: Year-end increase to 73 codes

This cyclical pattern suggests a more sophisticated promotional strategy, with carefully timed peaks and valleys designed to maximize customer acquisition efficiency while maintaining overall margins.

2025: Strategic precision

Early 2025 data indicates further refinement of HelloFresh's promotional approach:

January-April 2025: Moderate but consistent promotional activity ranging from 27 to 57 codes monthly

Increased emphasis on higher-value offerings like 50% off storewide and 70% off storewide

More targeted first-box promotions focusing on new customer acquisition

This evolution suggests HelloFresh is moving toward more strategic precision in their promotional efforts, emphasizing quality and timing over sheer quantity of promotional codes.

HelloFresh's seasonal promotional calendar

Based on our multi-year analysis, we can construct a reliable seasonal calendar of HelloFresh promotional opportunities to guide meal kit subscription decisions throughout the year.

Summer: Peak promotional season

The summer shopping season represents HelloFresh's most aggressive promotional period:

July: Historically the strongest promotional month (443 codes in 2023)

August: Continued strong activity (104 codes in 2023)

Best offers: 60% off storewide, $40 off storewide, up to $143 off storewide

Strategy recommendation: July represents the optimal time to initiate a new HelloFresh subscription or reactivate a dormant account to capture maximum discounts.

Winter: Valentine's and comfort food push

Winter months show concentrated promotional activity:

February: Strong promotional month (127 codes in 2024, 57 in 2025)

January: Moderate but consistent activity (37 codes in 2024, 35 in 2025)

Best offers: 50% off storewide, $40 off your first box, 35% off your first 3 boxes

Strategy recommendation: February offers the best winter opportunity for subscription initiation or renewal, particularly before Valentine's Day.

Fall: Back-to-routine opportunity

Fall represents a remarkably consistent promotional period:

September: Exactly 93 promotional codes in both 2023 and 2024

October-November: Moderate but significant activity

Best offers: $40 off storewide, free gift storewide, free shipping storewide

Strategy recommendation: September offers reliable promotional opportunities, particularly for back-to-school meal planning needs.

Holiday season: End-of-year push

December shows increasing promotional emphasis:

December 2023: 48 promotional codes

December 2024: 73 promotional codes, representing a 52% year-over-year increase

Best offers: 50% off plans, $80 off sale + free shipping, up to $143 off storewide

Strategy recommendation: December offers increasingly valuable promotional opportunities, particularly for gift subscriptions and holiday meal planning.

HelloFresh promo code composition and types

Analysis of HelloFresh's promotional code structure reveals distinct patterns in how they position and target their discounts.

Dollar-off vs. percentage-off promotions

HelloFresh employs both dollar-amount and percentage discounts, with clear patterns in their usage:

Dollar-amount formats:

$40 off storewide: Most common promotion (42 occurrences)

$40 off your purchase/order/first box: Common variations (16 combined occurrences)

$80 off sale + free shipping: Premium offering (6 occurrences)

Percentage-off formats:

60% off storewide: Highest frequency percentage discount (15 occurrences)

40% off storewide: Secondary percentage option (10 occurrences)

50% off storewide: Alternative percentage approach (10 occurrences)

50% off plans: Plan-specific variation (5 occurrences)

This mixed approach suggests HelloFresh strategically deploys different discount formats to appeal to various consumer psychology preferences—some customers respond better to concrete dollar amounts, while others find percentage discounts more compelling.

Storewide vs. limited promotions

HelloFresh shows a strong preference for storewide promotions:

Storewide discounts: Represent the majority of promotional codes

Limited promotions: Usually focus on "first box" or "first 3 boxes" to incentivize new subscriptions

This storewide emphasis differs from many competitors who focus more heavily on limited introductory offers. The prevalence of storewide codes suggests HelloFresh's confidence in their product's retention power once customers experience the service.

Free offerings and add-ons

HelloFresh strategically uses free add-ons to enhance perceived value:

Free shipping: A common standalone offer (4 occurrences) or combined with other discounts

Free gifts: Occasional promotions offering additional items (18 occurrences from 2023-2025)

Combined offers: $80 off sale + free shipping representing their highest-value combined promotion

These free offerings create additional perceived value while potentially having lower actual cost impact than deeper percentage discounts.

Strategic shopping approach for HelloFresh in 2025

Based on our multi-year analysis, we can project key promotional windows and strategies for HelloFresh shoppers in 2025.

Primary shopping windows for 2025

HelloFresh's historical patterns suggest these optimal subscription windows for 2025:

July 2025: Historically the year's premier promotional period, likely to feature maximum discount offers

February 2025: Already demonstrated strong promotional activity (57 codes)

September 2025: Based on consistent year-over-year patterns, will likely feature significant promotional activity

December 2025: Expected to continue the upward trend in holiday-focused promotions

New customer vs. returning customer strategies

HelloFresh offers distinct opportunities for different customer types:

New customers:

Focus on first-box promotions: $40 off your first box

Target percentage discounts: 60% off storewide

Look for high-value offers: Up to $143 off storewide

Returning customers:

Watch for "any purchase" promotions: Save $40 on any purchase

Focus on order-based discounts: $40 off your next delivery

Target storewide sales without "first box" limitations

Subscription timing optimization

Strategic subscription management can maximize savings:

Initial subscription: Time for July or February maximum discount periods

Subscription pauses: Consider pausing during low-promotion months (May-June)

Reactivation timing: Target September or December for optimal reactivation offers

Meal plan selection strategy

Different meal plans show varying discount patterns:

2-person plans: Often feature the deepest percentage discounts

Family plans: More frequently targeted with dollar-amount discounts

Specialty plans (vegetarian, etc.): Watch for plan-specific "50% off plans" promotions

Early 2025 promotional signals

Data through May 2025 shows several indicators for this year's promotional patterns:

January 2025 saw 35 promotional codes, comparable to January 2024 (37 codes)

February 2025 featured 57 promotional codes, less than February 2024 (127) but still significant

March-April 2025 maintained moderate but consistent promotional activity

May 2025 has already shown 45 promotional codes, a dramatic increase from May 2024 (3 codes)

These early 2025 patterns suggest HelloFresh is adjusting its promotional calendar, potentially shifting emphasis earlier in the summer season with May 2025 already showing significant promotional activity.

The substantial May 2025 increase may indicate a strategic shift to capture summer meal planning customers earlier, possibly in response to competitive pressures or changing consumer behavior patterns.

Maximizing your HelloFresh shopping strategy

Two years of HelloFresh promotional data reveal clear patterns that savvy meal kit shoppers can leverage:

Target July for maximum savings: Historically offers the year's deepest discounts across the widest range of offerings

Don't overlook February: Consistently delivers strong promotional activity, particularly around Valentine's Day

Watch for September opportunities: Shows remarkable year-over-year consistency as a key promotional window

Focus on storewide promotions: With "$40 off storewide" and "60% off storewide" representing the most frequent offerings

Timing is everything: Strategic subscription timing can save hundreds annually

By understanding these patterns and planning subscriptions accordingly, meal kit shoppers can save up to 70% on quality meal deliveries throughout 2025.

The data suggests HelloFresh's promotional approach continues to evolve, with early 2025 showing signs of a potential shift toward more evenly distributed promotional activity throughout the year. This evolution presents both challenges and opportunities for strategic shoppers.

Looking for current HelloFresh deals? Find verified HelloFresh promo codes here

How we get this data: Promo code data is sourced from our proprietary database that continuously monitors over 400,000 retailers. Every code is verified through our dual AI and community testing process.

by Sean Fisher

AI Content Strategist · Demand.io

Sean Fisher is an AI Content Strategist at Demand.io, where he leads content initiatives and develops an overarching AI content strategy. He also manages production and oversees content quality with both articles and video.

Prior to joining Demand.io in September 2024, Sean served as a Junior Editor at GOBankingRates, where he pioneered the company's AI content program. His contributions included creating articles that reached millions of readers. Before that, he was a Copy Editor/Proofreader at WebMD, where he edited digital advertisements and medical articles. His work at WebMD provided him with a foundation in a detail-oriented, regulated field.

Sean holds a Bachelor's degree in Film and Media Studies with a minor in English from the University of California, Santa Barbara, and an Associate's degree in English from Orange Coast College.