As AI technology continues to advance at breakneck speed, it's opening up new avenues for people to cut costs and make smarter financial decisions.

From scouring the internet for the best deals, to predicting price drops, and even negotiating your bills down to the last cent, this is the reality of AI-powered savings tools that available right now. You just have to go use them. And the best part? These AI helpers are getting smarter every day, learning from millions of transactions to find savings opportunities you might never have discovered on your own.

Demand.io, an AI-first company at the forefront of e-commerce innovation, is leading the charge in developing AI-driven savings tools for online shoppers. Founder and CEO, Michael Quoc, describes the future of AI-driven savings as "like having a smart, tireless personal shopper working for you 24/7."

AI shopping helpers are not just getting better at finding deals tailored to your preferences; they're also starting to look for savings proactively, without you even having to ask.

Ready to put AI to work for your wallet?

AI-powered tools to save you money

Artificial Intelligence is revolutionizing the way we manage our finances and find savings opportunities. Let's explore the various types of AI-powered tools that can help you keep more money in your pocket:

Budgeting and expense tracking

AI-powered budgeting apps are like having a personal financial advisor in your pocket. They can:

Automatically categorize your expenses

Predict future spending patterns

Suggest ways to cut costs

Popular tools:

Wally: Offers AI-driven insights into your spending habits

Cleo: Uses a chatbot interface to make budgeting more engaging

YNAB (You Need A Budget): Employs AI to help you plan for future expenses

How it helps: These apps take the guesswork out of budgeting, helping you understand where your money goes and identifying areas where you can save.

Shopping assistants

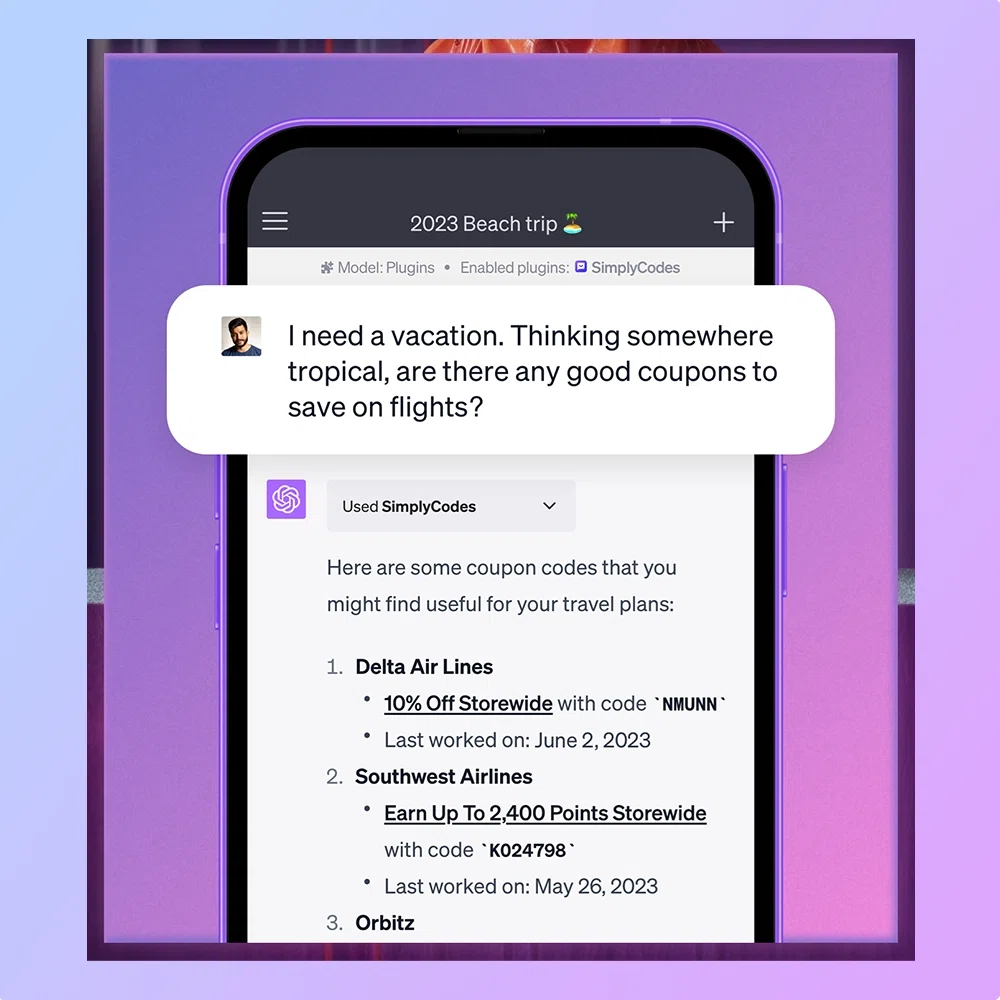

Image of user on the ChatGPT SimplyCodes plugin to get the best deals on flights.

These tools use AI to scour the internet for the best deals, ensuring you never overpay for your purchases.

Popular tools:

SimplyCodes: Uses AI to find and verify promo codes across over 400,000 stores

PriceGrabber: Compares prices across multiple retailers

Keepa: Tracks Amazon prices and alerts you to the best time to buy

How it helps: By automatically finding the best prices and applying promo codes, these tools can save you significant money on your online purchases without the time-consuming legwork.

Investing tools

AI is making smart investing more accessible to everyone, not just financial experts.

Popular tools:

Magnifi: Provides personalized investment advice based on AI analysis

Wealthfront: Offers AI-driven portfolio management

Betterment: Uses AI to rebalance your portfolio and minimize taxes

How it helps: These robo-advisors analyze market trends and your personal financial situation to create and manage investment strategies tailored to your goals.

Debt management

Managing and reducing debt becomes easier with AI tools that analyze your financial situation and suggest optimal strategies.

Popular tools:

Tally: Helps manage credit card debt and find lower interest rates

Chipper: Uses AI to help you manage and pay off student loans more efficiently

How it helps: These platforms can help you develop a personalized debt repayment plan, potentially saving you money on interest and helping you become debt-free faster.

Bill negotiation

AI is now capable of negotiating lower rates on your recurring bills, saving you money with minimal effort.

Popular tools:

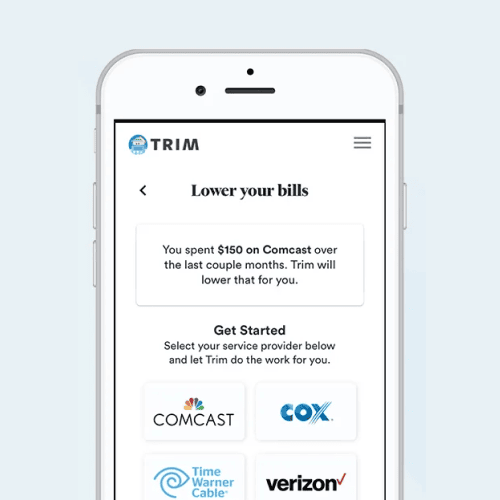

Truebill: Analyzes your subscriptions and negotiates bills on your behalf

Trim: Uses AI to find and cancel unnecessary subscriptions and negotiate bills

How it helps: These services can often secure discounts on cable, internet, and phone bills that you might not have been able to get on your own.

Energy management

Smart home devices powered by AI can significantly reduce your energy costs.

Popular tools:

Nest Learning Thermostat: Uses AI to optimize your home's temperature settings

Sense: Monitors your home's energy usage and suggests ways to reduce consumption

How it helps: By learning your habits and automatically adjusting settings, these devices can lower your energy bills without sacrificing comfort.

Travel booking

AI is changing the way we book travel, helping us find the best deals at the right time.

Popular tools:

Hopper: Predicts flight and hotel prices to help you book at the optimal time

Kayak: Uses AI to forecast travel prices and recommend the best times to book

How it helps: These tools analyze vast amounts of data to predict price trends, potentially saving you hundreds on flights and accommodations.

Financial security

While not directly a savings tool, AI-enhanced security features protect your money from fraud, potentially saving you from significant losses.

How it helps: Many banks and credit card companies now use AI to detect unusual patterns in your transactions, alerting you to potential fraud before it becomes a major issue.

Remember, the key to maximizing these tools is to use them consistently and act on their recommendations. Start with one or two that align with your biggest financial goals, and gradually incorporate more as you become comfortable with AI-assisted money management.

Want to boost your income? Read here on how to make money using AI

How to make the most out of your AI-powered savings

Use multiple tools: Different apps excel in various areas. Combine a budgeting app with a trusted promo code deal finder for massive savings.

Regularly review and adjust: While AI does much of the heavy lifting, review your settings and adjust as your financial situation changes.

Follow through on recommendations: These tools are most effective when you act on their insights. Whether it's canceling a subscription or negotiating a bill, take action to realize the potential savings.

Secure your data: When using financial apps, always prioritize those with strong security measures to protect your sensitive information.

Start small and scale up: If you're new to AI-powered finance tools, start with one or two apps and gradually incorporate more as you become comfortable with the technology.

The future of savings

As AI technology continues to evolve, we can expect even more sophisticated tools to help us save money. Here are some trends to watch:

Hyper-personalization: AI will provide increasingly tailored financial advice and savings opportunities based on your unique spending patterns and financial goals.

Predictive savings: Advanced AI algorithms will anticipate future expenses and automatically adjust your savings strategy to meet your goals.

AI-powered financial assistants: We may see the rise of comprehensive AI financial assistants that can manage all aspects of your financial life, from budgeting to investing to tax planning.

Integration with smart home technology: AI savings tools may integrate more deeply with smart home devices, optimizing everything from your energy usage to your grocery shopping based on real-time data.

Enhanced fraud detection: AI will become even better at detecting and preventing financial fraud, potentially saving consumers billions in losses.

You hold the power to your savings

Staying informed about new AI-powered financial tools and being open to incorporating them into your financial strategy could lead to significant savings and improved financial health. Use AI as a tool to inform and enhance your financial decisions, but always apply your own critical thinking and personal goals to the process.

More articles

by Sean Fisher

AI Content Strategist · Demand.io

Sean Fisher is an AI Content Strategist at Demand.io, where he leads content initiatives and develops an overarching AI content strategy. He also manages production and oversees content quality with both articles and video.

Prior to joining Demand.io in September 2024, Sean served as a Junior Editor at GOBankingRates, where he pioneered the company's AI content program. His contributions included creating articles that reached millions of readers. Before that, he was a Copy Editor/Proofreader at WebMD, where he edited digital advertisements and medical articles. His work at WebMD provided him with a foundation in a detail-oriented, regulated field.

Sean holds a Bachelor's degree in Film and Media Studies with a minor in English from the University of California, Santa Barbara, and an Associate's degree in English from Orange Coast College.