In today's economy, with inflation impacting our wallets, finding ways to save money is more crucial than ever. Enter inflation coupons – your secret weapon against rising prices. This comprehensive guide will show you how to leverage coupons effectively to maintain your lifestyle without breaking the bank.

1. Understanding inflation and its impact of your wallet

Inflation is the rate at which the general level of prices for goods and services rises, eroding purchasing power. As of June 2024, the annual inflation rate in the United States stands at 3.0%. While this is lower than the peak in 2022, it still means your money doesn't go as far as it used to.

Key inflation impacts:

Food prices: Up 2.2% year-over-year

Energy costs: Rose 2.1% year-over-year

Housing: Increased 5.2% year-over-year

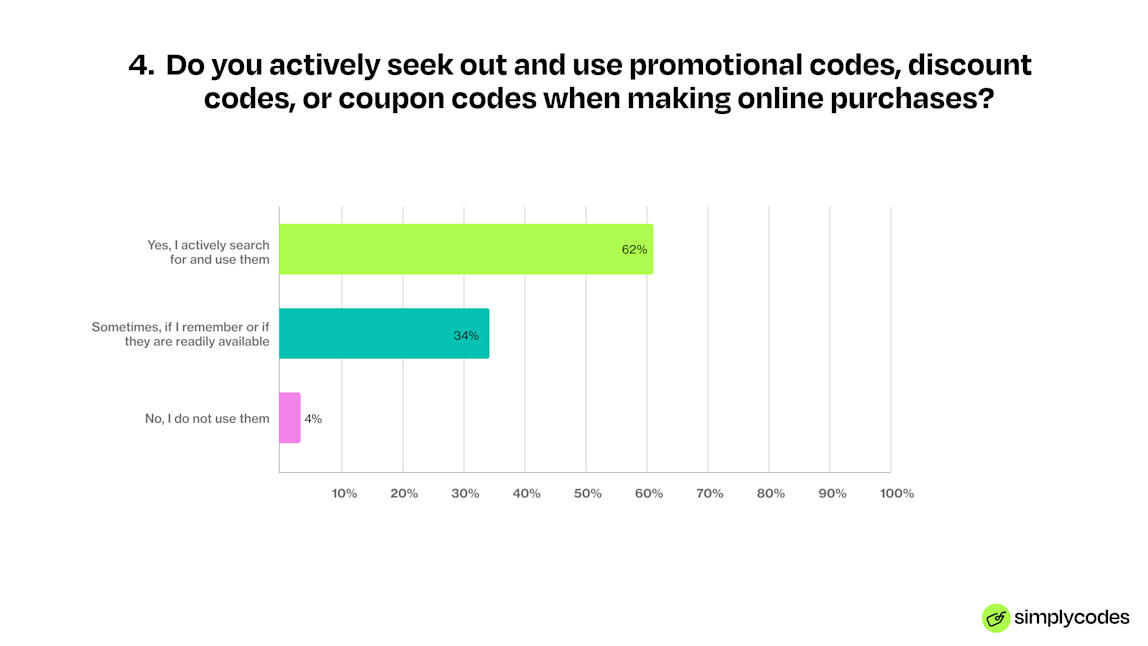

With these rising costs, it's no wonder that 62% of consumers are actively seeking deals and discounts to save money. The impact of inflation is felt across various sectors, affecting everything from your weekly grocery bill to your monthly rent. This widespread increase in prices makes it essential to find effective ways to stretch your dollars further.

2. What are inflation coupons?

Inflation coupons aren't a specific type of coupon, but rather a strategy of using coupons to offset the effects of inflation. This approach involves:

Actively seeking out and using coupons for everyday items

Focusing on coupons for products most affected by inflation

Combining multiple savings methods to maximize discounts

By using inflation coupons strategically, you can effectively reduce your expenses and maintain your purchasing power despite rising prices. This approach is particularly effective when applied to categories that have seen significant price increases due to inflation.

For example, if you notice that dairy products have become significantly more expensive, you might focus on finding and using coupons specifically for milk, cheese, and yogurt. By doing so, you can offset the inflation-driven price increases in this category and maintain your usual consumption habits without overspending.

3. How to Find and Use Inflation Coupons

Finding and using inflation coupons effectively requires a systematic approach:

Digital coupon sources:

Coupon websites (Coupons.com, RetailMeNot)

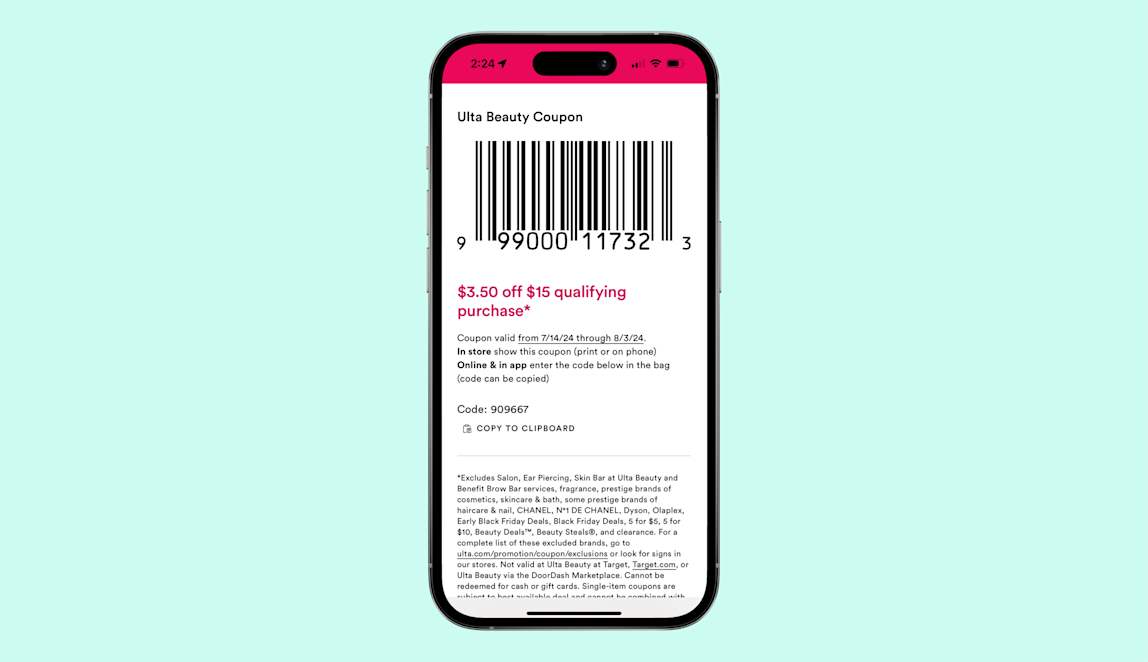

Mobile extensions like SimplyCodes on Safari, which offers verified coupon codes for thousands of retailers.

Traditional sources:

Sunday newspaper inserts

In-store flyers and catalogs

Direct mail coupons

Effective usage tips:

Organize coupons by expiration date and product category

Combine manufacturer and store coupons when possible

Stay informed about store coupon policies

When searching for inflation coupons, pay special attention to items that have seen significant price increases. For instance, if you notice that meat prices have risen sharply, prioritize finding coupons for various meat products. This targeted approach can help you maintain your usual diet without exceeding your budget.

Remember to check for coupons regularly, as new offers become available frequently. Many stores release new coupons weekly, often coinciding with their sales cycles. By staying on top of these releases, you can maximize your savings potential.

4. Digital Tools and Apps for Smart Couponing

Leverage technology to streamline your couponing efforts:

1. Coupon apps:

Ibotta: Offers cashback on grocery and retail purchases

Rakuten: Provides cashback at over 3,500 stores

Fetch Rewards: Gives points for scanning any receipt

2. Browser extensions:

SimplyCodes browser extension: Automatically finds and applies the best working coupon codes

Capital One Shopping: Compares prices across retailers and applies coupons

Honey: Searches for coupon codes and compares prices

3. Store-specific sites:

These digital tools can significantly reduce the time and effort required to find and use inflation coupons effectively. By automating much of the coupon-finding process, they allow you to focus on strategic shopping and maximizing your savings.

For example, browser extensions like SimplyCodes can automatically search for and apply the best available coupon codes when you're shopping online. This not only saves you time but also ensures you're getting the best possible deal, even if you weren't aware of an ongoing promotion.

Similarly, cashback apps like Ibotta and Rakuten can provide additional savings on top of your coupon usage. By stacking these different savings methods, you can significantly offset the effects of inflation on your purchasing power.

5. Advanced Couponing Strategies to Beat Inflation

Take your couponing to the next level with these advanced techniques:

Coupon stacking: Combine multiple discounts on a single purchase. For example, use a manufacturer coupon with a store coupon on an item that's already on sale.

Price matching: Take advantage of price matching policies to get the lowest price while using coupons.

Rebate apps: Use apps like Ibotta or Checkout 51 in addition to coupons for extra savings.

Timing purchases: Learn sales cycles and time your purchases to coincide with the best deals and available coupons.

Bulk buying: When you have high-value coupons, consider buying in bulk if it's a product you use frequently. Stores like Costco often offer additional savings on bulk purchases.

Clearance shopping: Look for clearance items and combine them with coupons for extreme savings.

Rain checks: If a sale item is out of stock, ask for a rain check. This allows you to purchase the item at the sale price when it's back in stock, even if your coupons have expired by then.

By implementing these advanced strategies, you can significantly increase your savings and combat the effects of inflation on your budget. Remember, the key is to be strategic and organized in your approach to couponing.

6. Couponing Across Different Product Categories

Tailor your couponing strategy to different product categories:

Groceries

Focus on store loyalty programs

Use apps like Ibotta for additional savings

Plan meals around sale items and available coupons

Look for "loss leader" items - products priced below cost to attract customers

Household items

Stock up on non-perishables when prices are low and you have coupons

Consider generic brands and compare prices after applying coupons

Look for bundle deals where you can use coupons on multiple items

Personal care products

Look for BOGO (Buy One Get One) deals and combine with coupons

Check drugstore rewards programs like CVS ExtraCare for additional savings

Consider subscribing to product-specific newsletters for exclusive coupons

Clothing and accessories

Sign up for retailer newsletters to get exclusive coupons

Shop end-of-season sales and use coupons for maximum savings

Look for online outlet stores of your favorite brands

Electronics

Time your purchases with major sales events like Black Friday or Cyber Monday

Use price comparison tools in conjunction with coupons

Consider open-box or refurbished items for additional savings

Travel and entertainment

Look for package deals and apply coupons when possible

Use sites like Groupon for local entertainment deals

Consider loyalty programs for airlines and hotels

By applying category-specific strategies, you can maximize your savings across all areas of spending. Remember to always calculate the final price after applying coupons and compare it to the regular price of alternative brands or products to ensure you're getting the best deal.

7. Ethical Couponing and Best Practices

Practice responsible couponing:

Follow store policies and coupon terms strictly

Don't clear shelves or buy excessive quantities

Use coupons only for products you need or regularly use

Be respectful to store employees and other shoppers

Ethical couponing is not just about following rules; it's about being a responsible consumer. Here are some additional best practices to consider:

Don't buy products just because you have a coupon. Stick to items you actually need or will use.

Be mindful of expiration dates, especially when buying in bulk. It's not a deal if the product goes bad before you can use it.

Consider donating excess items to local food banks or shelters if you end up with more than you can use.

Be patient and courteous at the checkout. If there's a problem with a coupon, calmly explain the situation or ask to speak with a manager.

Share deals and coupons with friends and family. Creating a couponing network can help everyone save more.

Be aware of the environmental impact of excessive printing or newspaper purchases. Opt for digital coupons when possible.

By following these ethical guidelines, you can enjoy the benefits of couponing while being a considerate shopper and community member.

8. Real-Life Success Stories: How People Are Saving with Inflation Coupons

Learn from these inspiring examples:

Kayla Burk: This 27-year-old turned her couponing hobby into a full-time career, amassing over 2 million TikTok followers with her money-saving tips. Key strategies include utilizing store-specific apps for coupons, leveraging cashback apps, and capitalizing on store specials for rarely discounted items

Joanie Demer: Co-founder of The Krazy Coupon Lady website, Joanie has been using coupons for over a decade to support her family. Her approach includes combining manufacturer coupons with store sales, using rebate apps, and purchasing discounted gift cards for additional savings. The Demer family saves an average of $8,000 per year through these methods.

Sarah J.: Reduced her monthly grocery bill by 40% using a combination of store apps, cashback offers, and strategic bulk buying. She focuses on stocking up on non-perishable items when they're on sale and she has coupons. Sarah also meal plans around the weekly sales circular, incorporating coupons into her strategy.

Kyle James: Founder of Rather-Be-Shopping.com, Kyle always price-compares and coupon shops, even checking eBay for refurbished prices. He often snags products for 50-80% off the retail price and typically saves over $1,000 around Christmas and his kid's birthdays.

These success stories demonstrate that with the right strategies and tools, significant savings are possible even in an inflationary economy. The key takeaway from all these examples is the importance of consistency, organization, and a willingness to adapt to new saving methods.

9. The Future of Couponing in an Inflationary Economy

As we look ahead, several trends are shaping the future of couponing:

Increased personalization: AI and machine learning will drive more personalized coupon offers based on individual shopping habits and preferences.

Mobile-first approach: With the growing prevalence of smartphones, expect to see more mobile-exclusive coupons and deals.

Integration with smart home devices: Voice-activated assistants may soon be able to find and apply coupons for you.

Augmented reality couponing: AR technology could allow shoppers to see personalized deals overlaid on products as they walk through a store.

Blockchain-based coupons: This technology could be used to create secure, non-duplicable digital coupons.

Social media influence: Expect to see more coupon sharing and deal announcements through social media platforms.

Subscription-based coupon services: Premium services offering exclusive deals and higher-value coupons may become more common.

Environmental considerations: As sustainability becomes more important to consumers, look for more paperless coupon options and eco-friendly deal structures.

To stay ahead in this evolving landscape, focus on embracing digital tools, combining multiple savings methods, and staying flexible in your approach to finding the best deals. Keep an eye on emerging technologies and be ready to adapt your couponing strategies as new opportunities arise.

10. Staying afloat and getting ahead during inflation

In these inflationary times, mastering the use of coupons can significantly impact your budget and help maintain your lifestyle. By leveraging both traditional and digital couponing methods, staying informed about deals, and practicing smart shopping habits, you can effectively combat rising prices.

Remember, successful couponing is about consistency and strategy, not extreme measures. Start small, perhaps focusing on one store or category, and gradually expand your efforts as you become more comfortable. With practice, you'll develop a system that works for you and your family.

As you embark on your couponing journey, keep these key points in mind:

Stay organized and plan ahead

Combine multiple savings methods for maximum impact

Be flexible and willing to try new brands or shopping strategies

Use technology to your advantage

Practice ethical couponing

Share your knowledge and learn from others

By implementing these strategies and staying committed to smart shopping, you can navigate inflationary periods more easily and maintain your purchasing power.

Ready to start saving? Try SimplyCodes' coupon tool for free and start applying the best coupon codes automatically as you shop online. With access to millions of verified coupon codes, you'll be well on your way to outsmarting inflation and securing significant savings.

Remember, every dollar saved through couponing is a dollar earned in the fight against inflation. Happy saving!

11. Frequently Asked Questions

Q1: How much can I save using inflation coupons?

A1: The average American can save $122 per month or $1,465 per year using online and mobile coupon codes. With advanced strategies, some couponers report savings of 30-50% on their grocery bills.

Q2: Are digital coupons better than paper coupons for fighting inflation?

A2: Digital coupons often offer more convenience and are increasingly prevalent. However, a combination of both digital and paper coupons can maximize your savings opportunities in inflationary times.

Q3: How can I start using inflation coupons without getting overwhelmed?

A3: Start small by focusing on coupons for items you regularly buy. Use digital tools like the SimplyCodes browser extension to streamline the process. Set realistic goals and gradually expand your efforts as you become more comfortable with couponing strategies.

Q4: Can I use inflation coupons for online shopping?

A4: Absolutely! Many retailers offer online coupons, and tools like browser extensions can automatically find and apply the best coupon codes for you as you shop.

Q5: How often should I look for new inflation coupons?

A5: It's a good idea to check for new coupons weekly, as many stores release new deals and coupons on a weekly basis. However, using a tool like SimplyCodes can help you find the latest coupons automatically without constant manual searching.

More articles

by Michael Quoc

CEO · Demand.io

Michael Quoc is the founder and CEO of Demand.io. Michael founded Demand.io to apply AI, advanced engineering, and community-first principles to solve everyday consumer problems at scale. Michael's operating philosophy is to create aligned economic outcomes across his company, his employees, his community stakeholders, and business partners alike. Prior to founding Demand.io, Michael served as Head of Product at Yahoo, where he drove innovation across the Fortune 100 company's global network. Michael previously held product leadership roles at Desktop.com and investment and strategic advisory roles at Pequot Ventures and Jefferies Broadview. Michael studied Computer Science at UC Berkeley and holds a Bachelor's in Business Administration from the Haas School of Business at UC Berkeley.