High-low retailers mark products up 40-70% then discount them repeatedly, while EDLP stores maintain consistently low prices without promotional cycles

JCPenney's 2012 switch from high-low to honest pricing caused 25% sales collapse in one year, forcing a desperate return to fake sales

Walmart pioneered everyday low pricing in 1962 and built the world's largest retail empire on consistent value instead of promotional gimmicks

Macy's, Kohl's, and JCPenney paid $100+ million in legal settlements after prosecutors found fabricated "original prices" on thousands of products

Neuroscience research shows sale signs trigger 2x more dopamine than steady low prices, explaining why customers reject honest pricing

Which purchase feels smarter: a pair of jeans listed at $60, or an identical pair marked down from $120 to $60?

If you chose the "discounted" option, you've revealed the fundamental psychological split that divides American retail into two competing camps—and explains why some of the country's biggest retailers paid over $100 million in legal settlements for lying about their prices.

This isn't just about consumer psychology. It's about two fundamentally different retail strategies that create opposite shopping experiences.

So, what’s the difference?

High-low pricing: Where stores set inflated "regular" prices then create excitement through constant sales.

Everyday low pricing (EDLP): Where retailers maintain consistently low prices without promotional theatrics.

One strategy built Walmart into the world's largest company. The other nearly destroyed JCPenney when they tried to abandon it. SimplyCodes' analysis of pricing patterns, legal settlements, and retail case studies reveals why these strategies succeed or fail—and what happens when high-low pricing crosses the line from marketing tactic to systematic deception.

The two pricing philosophies that define American retail

American retail operates on a fundamental divide between two opposing approaches to pricing, each built on different psychological principles and operational models.

High-low pricing: The promotional cycle strategy

High-low pricing involves setting higher list prices on merchandise, then routinely offering promotions or discounts that temporarily lower those prices. In a high-low store, most items carry regular prices above market average, but a rotating selection is always "on sale" at significant discounts.

The operational cycle:

Set initial high price on new merchandise

Run promotional event (weekend sale, holiday discount, coupon offer)

Return to regular price after promotion ends

Repeat with next promotional cycle

A classic example: A department store prices a jacket at $100, then runs a "One-Day Sale: 50% off" where it sells for $50. After the sale, the price returns to $100 until the next promotion. In practice, most units sell at the discounted $50 price rather than the $100 "regular" price.

Major high-low retailers:

Macy's (constant promotions, coupon codes, "One Day Sale" events)

Kohl's (aggressive sales, "Kohl's Cash" rewards, perpetual discounts)

JCPenney (hundreds of sales annually, coupon mailers, clearance events)

Best Buy (weekly ad specials, holiday doorbusters, promotional cycles)

Nordstrom (semi-annual sales, Anniversary Sale events)

Everyday low pricing (EDLP): The consistent value strategy

Everyday low pricing establishes consistently low prices across merchandise that remain relatively stable over time, avoiding periodic deep discounts. EDLP stores promise that their regular prices are as low as customers will find anywhere, eliminating the need to wait for sales.

The operational approach:

Set low base price through cost efficiency and thin margins

Maintain stable pricing with minimal promotional events

Rely on high volume to compensate for lower per-item margins

Build trust through pricing consistency

Walmart's motto "Every Day Low Prices" epitomizes this strategy—the retailer promises shoppers that its normal prices represent ongoing bargains without gimmicks or waiting for the "right" time to buy.

Major EDLP retailers:

Walmart (rare coupon sales, occasional "Rollbacks" on select items)

Costco (fixed low markup model, membership-based wholesale pricing)

Home Depot (guaranteed low prices, price-match guarantees)

Dollar General/Dollar Tree (ultra-low fixed price points)

ALDI (limited selection, consistently low grocery prices)

The fundamental difference in consumer experience

Aspect | High-low pricing | Everyday low pricing |

Price stability | Constant fluctuation | Consistent pricing |

Shopping strategy | Wait for sales, hunt for deals | Buy when needed |

Promotional activity | Weekly ads, coupons, flash sales | Minimal promotions |

Psychological appeal | Excitement, urgency, "winning" | Trust, convenience, simplicity |

Typical margins | High markup, deep discounts | Thin margins, high volume |

Customer behavior | Deal-hunting, timing purchases | Regular shopping frequency |

The strategies aren't just different pricing approaches — they represent fundamentally different philosophies about how to create customer value and build retail businesses.

How high-low pricing became the dominant retail strategy

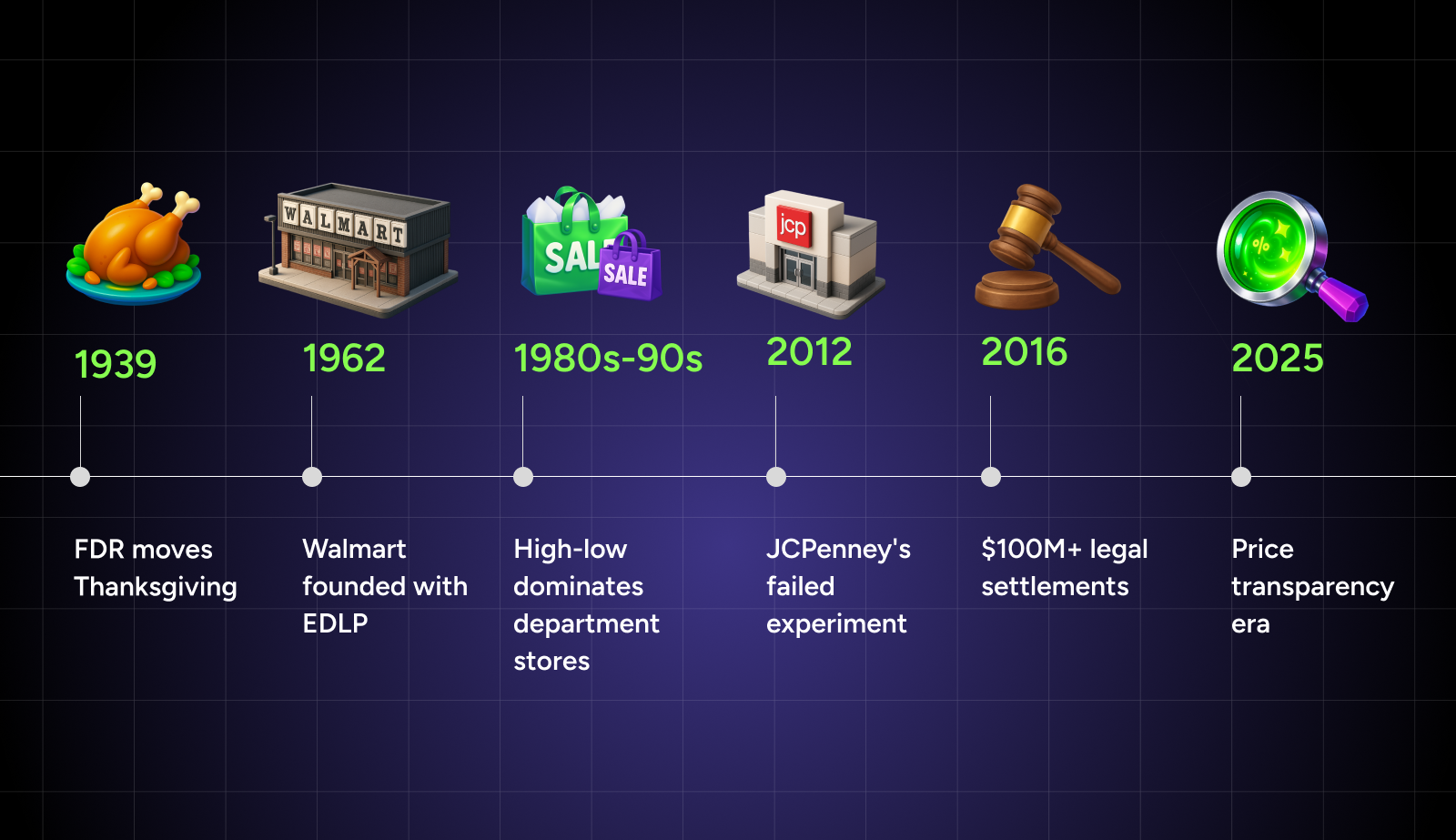

The dominance of high-low pricing in department stores, fashion retail, and specialty chains traces back to early 20th century retail evolution—and one man's successful campaign to extend the shopping season itself.

Fred Lazarus Jr. and the invention of modern promotional retail

The modern American sale culture has roots in an audacious 1939 lobbying effort that reshaped the national calendar.

Fred Lazarus Jr., founder of what would become Federated Department Stores (later Macy's parent company), identified a problem in the retail calendar. When November contained five Thursdays, Thanksgiving fell so late that retailers had only 24 shopping days until Christmas. Lazarus believed stores needed more time to capture holiday spending.

His solution — convince President Franklin D. Roosevelt to move Thanksgiving one week earlier.

Roosevelt agreed, issuing a presidential proclamation establishing the fourth Thursday of November as Thanksgiving, where it has remained since 1941. This single change added up to six shopping days to the holiday season—days that retailers have leveraged for their most aggressive promotional pushes ever since.

This wasn't just calendar optimization. Lazarus pioneered "high-low pricing"—setting elevated regular prices then running frequent sales to create perceived value. This approach would dominate department store strategy for the next 80 years, fundamentally shaping how Americans learned to shop.

The psychology that makes high-low pricing work

High-low pricing succeeds because it exploits several powerful psychological principles:

The anchoring effect: When shoppers see a high "original price" first, it establishes a mental reference point that makes the sale price seem more valuable—even if that original price was artificially inflated or rarely used for actual sales.

Scarcity and urgency: "Limited time" and "while supplies last" language triggers loss aversion, where people feel potential losses more intensely than equivalent gains. This creates pressure to buy now rather than risk missing the deal.

The dopamine factor: Neuroscience research from Robert Sapolsky reveals that uncertain rewards (like catching a flash sale) trigger approximately twice as much dopamine as guaranteed rewards. The neurochemical response to "finding a deal" overrides rational price evaluation.

Social proof and competition: Seeing other shoppers hunting for deals activates herd behavior, making the shopping experience feel validated and competitive. The ritual of deal-hunting becomes intrinsically rewarding.

Identity and self-concept: Regular sale shoppers build part of their identity around being "smart shoppers" who never pay full price. The promotional cycle reinforces this self-image with every "win."

For retailers, these psychological effects create powerful advantages. Shoppers conditioned to expect sales actively avoid paying "full price," even when that full price is reasonable or the sale price is actually the normal market rate.

Why retailers choose high-low pricing

Despite its complexity, high-low pricing offers several strategic advantages:

Revenue maximization through price discrimination: High-low pricing captures customers with different willingness to pay. Initially, products sell at higher prices to less price-sensitive customers. Later, discounts capture more price-sensitive shoppers. Over a product's lifecycle, the average realized price may exceed what simple EDLP pricing would achieve.

Traffic generation and impulse purchases: Big advertised sales create excitement and boost store traffic. Once customers arrive for the promoted item, they often buy additional products at regular prices. This cross-selling effect increases basket size and overall profitability.

Inventory management flexibility: Promotional cycles provide tools to manage inventory levels and product lifecycles. If items aren't selling at regular price, markdowns clear space without permanently slashing prices on all stock.

Brand excitement and buzz: Frequent promotions keep brands in customers' minds. There's always a new deal to discuss, generating word-of-mouth and repeat visits. The constant activity creates a brand image that's dynamic and deal-friendly.

Customer base expansion: Deal-seeking shoppers—a significant market segment—are drawn to retailers known for big discounts. High-low strategy can expand customer base by attracting bargain hunters who might not visit otherwise.

When high-low pricing becomes systematic deception

The psychological power of sale signs created temptation for retailers to manipulate the numbers—leading to legal action when promotional pricing crossed from marketing into fraud.

The 2016 legal reckoning: Fake "original prices" exposed

Los Angeles City Attorney Mike Feuer's investigation revealed systematic violations at multiple major retailers, documenting how "original prices" had become fictions designed to manufacture the appearance of deals.

NBC News covered this story, quoting Feuer saying in 2016, "Customers have the right to be told the truth about the prices they’re paying — and to know if a bargain is really a bargain,”

Macy's violations: Prosecutors found thousands of products with fabricated "original prices." One egregious example: a sterling silver necklace advertised as "Originally $120, now $30" when Macy's had never sold it above $30. The launch price was $30, making the 75% discount completely fabricated.

The tactic extended across categories. Macy's would reference a manufacturer's suggested retail price of $200 for a coat, mark it as "Originally $400," then sell it at $199 during a "50% off sale." Shoppers believed they were getting incredible deals when $199 was simply the normal market price.

JCPenney's fabricated baselines: The retailer advertised a maternity bathing suit top as "originally $46, now $21.99" when the highest price it had ever been sold for was $32. The "30% off" was calculated from a fictional baseline that had never existed in practice.

Kohl's systematic inflation: Kohl's operated with most products showing inflated "original prices" and perpetual "sales." A dress might be "60% off" nearly every week, creating constant perception of deals while the "sale price" was effectively the regular selling price.

The settlements:

The legal consequences proved manageable for the retailers involved:

JCPenney: $50 million settlement

Macy's: n/a

Kohl's: $6.15 million settlement

Sears: Included in multi-retailer settlement

Mike Feuer's assessment captured the core issue: this wasn't pricing error—it was "a major part of their marketing strategy." The fabricated reference prices were central to how these retailers created the perception of value.

The fine print solution: Legal deception

The lawsuits forced retailers to adjust tactics, but not abandon the strategy. The solution? Legal disclaimers that technically disclose the deception while burying it where few shoppers see it.

Kohl's current website disclaimer: "Actual sales may not have been made at the Regular or Original prices... Original prices may not have been in effect during the past 90 days or in all trade areas."

Translation: That "original price" we're showing you might never have been used for actual sales, might not have been in effect recently, and might not apply in your area.

Macy's customer service policy: Items showing "Regular" or "Original" prices "may not have been sold at those prices, so the savings shown may not be based on actual sales."

These admissions are remarkable for their candor about dishonesty. Retailers essentially state: "We're showing you reference prices to make discounts look appealing, but we're legally covering ourselves by admitting they might be meaningless."

How everyday low pricing built Walmart into the world's largest retailer

While department stores perfected promotional pricing, one discount retailer proved a radically different approach could achieve even greater success.

Sam Walton's everyday low price vision

In 1962, Sam Walton opened his first Wal-Mart discount store with a mission to serve small-town America with rock-bottom prices. Walton pioneered an everyday low price strategy and built an entire business model around aggressive cost-cutting to support it.

Walmart puts it this way, writing: “As for EDLP, it’s all about building trust with our customer by never letting them down on price. Helping people save money so they can live better. All the time. Every time.”

This approach was revolutionary. Competitors like Kmart (founded the same year) used traditional promotional pricing with periodic "Blue Light Specials"—unadvertised in-store flash sales. Walmart instead focused on keeping prices low every day and minimizing temporary promotions.

The EDLP foundation:

By operating on thinner profit margins and driving operational efficiency, Walmart proved high volume could compensate for low per-item margins. Shoppers learned to trust that Walmart "always has low prices" without needing to shop around for sales.

Everyday low cost (EDLC) discipline:

EDLP required everyday low cost—keeping procurement, supply chain, and overhead costs as minimal as possible so savings could pass to customers. Walmart became legendary for:

Aggressive supplier negotiations

Distribution center efficiency

Inventory management optimization

Minimal store decoration or amenities

Lean staffing models

This cost obsession enabled the pricing strategy. Walmart could maintain prices competitors couldn't match because its operational efficiency was superior.

Why EDLP creates competitive advantage

Walmart's success with EDLP demonstrates several strategic advantages over high-low pricing:

Trust and loyalty building: EDLP builds customer trust through straightforward value. Shoppers don't second-guess whether today is the "right" day to buy. Walmart emphasizes "building trust with our customer by never letting them down on price...all the time."

Price leadership positioning: By keeping prices low daily, EDLP retailers become the default choice for value. Over time, this drives high sales volumes that create economies of scale, enabling even lower supplier costs—a virtuous cycle.

Operational efficiency: Fewer price changes mean less labor printing tags or setting up weekly sales displays. Inventory management becomes smoother since demand is steadier without huge swings for promotional events.

Consumer convenience: Some shoppers hate the hassle of coupons and timing sales. EDLP caters to them by simplifying the shopping experience. Customers can shop on their own schedule without fearing they're paying more than necessary.

Reduced marketing costs: EDLP companies save on the massive advertising spend high-low stores incur for weekly flyers and constant marketing of sales.

The Walmart vs. Kmart case study

The competitive battle between Walmart and Kmart illustrates EDLP's power against high-low pricing.

In the late 20th century, Kmart was initially as large as Walmart and equally known for discount retailing. However, Kmart stuck with high-low approach—"everyday prices" punctuated by periodic sales and Blue Light Specials—while Walmart doubled down on EDLP enabled by rigorous cost control.

The outcome: Over time, Kmart's sporadic deals couldn't overcome Walmart's baseline price advantage. Shoppers increasingly perceived "other retailers have everyday prices on their entire product line that's lower than Kmart's."

Kmart's sales and store count plunged, eventually leading to bankruptcy and store closures, while Walmart's consistent low pricing helped it dominate the discount sector. Analysts concluded that Walmart's everyday low approach was better suited to the competitive retail environment and changing consumer expectations.

The lesson: When one competitor successfully establishes EDLP, high-low retailers struggle unless they can differentiate through product selection, experience, or service rather than pure price.

The JCPenney disaster: When honesty failed spectacularly

The most revealing chapter in the high-low vs. EDLP story isn't about deception—it's about what happened when one retailer tried to abandon promotional pricing entirely.

Ron Johnson's "Fair and Square" pricing revolution

In 2011, JCPenney hired Ron Johnson, the executive who had revolutionized Apple's retail stores, as their new CEO. Johnson looked at JCPenney's pricing tactics with an outsider's eyes and was appalled.

He observed that 50-70% of all JCPenney sales occurred at discounted prices. The high "regular" prices had become nominal—virtually all actual sales happened during promotions. Johnson believed this was "department stores' biggest problem" and called them "mark up to mark down gimmicks."

The Fair and Square launch:

On February 1, 2012, Johnson launched his pricing revolution:

40% price reduction across the board on most merchandise

Complete elimination of coupons and most sales events

End of promotional cycles and manufactured urgency

Transparent, honest pricing—the price you see is the price you pay, every day

A shirt that had been marked "$30, now $15" simply became $15 every day. Why not sell at $50 immediately instead of pricing at $100 and marking down later?

It was honest. It was straightforward. It was consumer-friendly.

It was a catastrophe.

The devastating results

Sales plummeted 25% in the first year alone. Customers didn't just fail to appreciate the honesty—they actively rejected it.

The backlash was immediate and visceral:

Shoppers found the new pricing "boring" and expressed confusion about the absence of sales

Long-time JCPenney customers felt betrayed, as if something essential had been taken from them

Store traffic dropped dramatically as customers stopped visiting

Many customers switched to competitors entirely

As Time magazine observed: "At some level, all shoppers know that a game is being played... shoppers actually like these games, and they're confused when it seems no game is being played."

After just 17 months, JCPenney's board fired Johnson. The company immediately launched an apology campaign: "Come back, we heard you!" The coupons returned. The sales resumed. Customers slowly trickled back.

Why honest pricing failed: The deeper psychology

The JCPenney experiment revealed profound truths about consumer psychology that go beyond simple manipulation:

The ritual matters as much as the savings. For many shoppers, the experience of hunting for deals, comparing discounts, and feeling like they "cracked the code" had become intrinsically rewarding—separate from actual money saved. Removing the game threatened that experience.

Identity investment. Regular sale shoppers had built part of their self-concept around being "smart shoppers" who never pay full price. Consistent pricing provided no opportunity to demonstrate this identity.

Dopamine conditioning. After decades of high-low pricing, customers' brains had been trained to seek the neurochemical reward of finding a deal. Consistent pricing provided no dopamine hit, even when prices were objectively better.

Loss of perceived value. Without the context of a high reference price, the new $15 price looked expensive compared to the previous "$30, now $15" framing. Customers couldn't evaluate value without the comparison anchor.

Competitive context mattered. Johnson admitted that even with Fair and Square pricing, JCPenney's prices often remained higher than Walmart's or other discount competitors. The "everyday" prices weren't low enough to position JCPenney as a genuine price leader.

The experiment demonstrated that for retailers with entrenched high-low customer bases, abandoning promotional pricing carries enormous risk—even when the intentions are honest and the new prices are objectively fair.

The hybrid approach: Combining the best of both strategies

As the retail landscape evolved, many successful retailers discovered that pure EDLP or pure high-low approaches left opportunities on the table. The solution: strategic combinations.

Target's segmented pricing model

Target positions itself between Walmart and department stores with a tagline reflecting this balance: "Expect More, Pay Less."

The hybrid execution:

EDLP on commodity items: Competitive everyday prices on groceries, diapers, household essentials—items shoppers compare across retailers

High-low on discretionary goods: Weekly promotions on apparel, home décor, electronics where "expect more" applies

CircleCard everyday discount: 5% discount for cardholders creates EDLP-like incentive across all purchases

Seasonal promotional events: Heavy participation in Black Friday, back-to-school sales, holiday promotions

This blend allows Target to compete with Walmart on essential items while maintaining excitement and differentiation through selective promotions on trend-driven merchandise.

Best Buy's evolution from pure high-low

Best Buy traditionally operated with weekly specials and holiday sales. However, the rise of smartphone-enabled price comparison and Amazon's competition forced adaptation.

The strategic shift: In 2011, Best Buy management acknowledged they had "trained consumers to wait for sales" in an era when Amazon could undercut prices any day. They couldn't maintain artificially high everyday prices when customers could instantly check competitor pricing.

The hybrid solution:

Price-match guarantee: Matching Amazon and major competitors essentially provides EDLP on core products

Competitive everyday pricing: Ensuring base prices aren't dramatically above market

Strategic promotions: Still running doorbusters and product launch events for excitement

Reduced gimmicks: Eliminating deceptive tactics like mail-in rebates

This approach maintains promotional elements that drive traffic while ensuring competitive everyday pricing prevents showrooming.

Home Depot's EDLP with selective promotions

Home Depot positions itself primarily as EDLP with "guaranteed low prices" and price-match policies. However, it layers selective promotions for specific goals:

Special Buy of the Day: Featured items at exceptional prices to create store traffic

Seasonal sales events: Spring garden sales, holiday promotions on specific categories

Pro contractor pricing: Bulk and volume discounts that serve professional customers

Core EDLP pricing: Consistently competitive on building materials, tools, everyday items

The strategy maintains EDLP trust while using targeted promotions to drive specific behaviors without creating overall expectation of constant sales.

The strategic logic of hybrid approaches

Successful hybrid strategies typically follow these principles:

Segment by product category: Use EDLP for commodity items where price comparison is easy and differentiation is low. Use high-low for unique, seasonal, or trend-driven items where promotions create excitement.

Segment by customer type: Offer consistent low prices to efficiency-minded shoppers while providing promotional opportunities for deal-hunters who enjoy the hunt.

Use data and personalization: Rather than blanket promotions, deliver targeted offers to specific customer segments based on shopping history and preferences.

Maintain strategic clarity: Avoid confusing customers about whether you're a price leader or promotional retailer. The hybrid approach should feel intentional, not inconsistent.

Balance frequency: Don't promote so frequently that customers wait for sales on everything, but provide enough promotional activity to maintain engagement and excitement.

The retailers succeeding in today's market often use sophisticated analytics to optimize when to maintain stable EDLP pricing and when to deploy strategic promotions—getting benefits of both approaches while minimizing their downsides.

How e-commerce is changing retail pricing strategies

Several powerful trends in the 2020s are forcing retailers to reconsider their pricing strategies and adapt to new competitive realities.

E-commerce and price transparency

Online shopping and smartphone price comparison have fundamentally changed the information asymmetry that high-low pricing depended on.

The transparency effect: Consumers can now instantly check prices across retailers, exposing artificially high "regular" prices. When a shopper can verify in seconds that a store's $100 "original price" is actually $60 everywhere else, the promotional illusion collapses.

Price comparison sites and browser extensions aggregate pricing data, making it trivial for shoppers to find the current best price. Retailers that maintain high base prices hoping customers won't notice are simply filtered out of consideration.

Advantages for EDLP: Price transparency benefits EDLP retailers—their consistent competitive pricing is easily discovered and appreciated through comparison shopping. Stores "following the EDLP strategy can be found easily" by price-sensitive customers scanning the web.

Challenges for high-low:

Online price transparency undermines several high-low tactics:

Customers can verify that "original prices" are inflated

Shoppers can wait for sales while monitoring prices across retailers

Cherry-picking becomes easier—buying only promotional items while sourcing everything else from EDLP competitors

Promotional windows must align across online and in-store channels

The Pricefx analysis suggested that “using data to track buying patterns” and potentially combining strategies will be crucial in an age of dynamic markets.

Retailer responses: Many retailers now use dynamic pricing algorithms that adjust prices frequently based on competition, demand, and inventory—creating a more sophisticated version of high-low that responds to market conditions in real-time rather than fixed weekly cycles.

The future of retail pricing: Will high-low and EDLP strategies merge?

Looking ahead, several forces suggest retail pricing strategies may evolve beyond the pure high-low vs. EDLP divide.

The push toward transparency

Growing consumer awareness, social media exposés, and legal pressure may force retailers toward more honest pricing practices:

Stricter regulations on "original price" definitions and disclosure requirements

Mandatory price history transparency showing how long items sold at reference prices

Penalties for perpetual "sales" that effectively become regular pricing

Consumer protection laws expanding beyond current settlement standards

California and other states have led consumer protection legislation. Federal action remains possible as fake sales become more widely recognized as systematically deceptive practices.

Technology as equalizer

Price tracking tools, browser extensions, and community verification platforms have fundamentally shifted information balance:

Consumer advantages:

Shoppers now access tools that reveal:

Historical pricing showing "sale" patterns over months

Cross-retailer price comparison in real-time

Community verification of coupon validity

Alert systems for genuine price drops versus fake sales

Retailer adaptations:

Retailers respond with more sophisticated approaches:

AI-powered dynamic pricing that adjusts based on competition and demand

Personalized offers targeting individual shoppers rather than blanket promotions

Real-time repricing to match or undercut competitors

Omnichannel coordination ensuring price consistency

The arms race between consumer transparency tools and retailer pricing optimization continues escalating, likely resulting in more sophisticated hybrid strategies rather than pure EDLP or high-low approaches.

The segmentation reality

Rather than one strategy dominating, evidence suggests the market is large enough for multiple approaches serving different consumer preferences:

EDLP segment: Shoppers prioritizing convenience, transparency, and efficiency will continue gravitating to Walmart, Costco, and similar retailers offering consistent value without games.

High-low segment: Customers who genuinely enjoy deal-hunting, coupon-stacking, and the promotional experience will continue supporting department stores and specialty retailers offering that shopping ritual.

Hybrid shoppers: An increasing segment uses price tracking and comparison tools to cherry-pick—buying promotional items from high-low retailers when deals are genuine while sourcing commodities from EDLP stores.

Premium segment: Higher-end retailers like Nordstrom use restrained high-low (a few major sale events annually) to maintain luxury positioning while still providing occasional promotional excitement.

This segmentation suggests continued coexistence rather than one strategy displacing the other.

Generational shifts

Younger consumers who grew up with unlimited price comparison access may prove less susceptible to traditional high-low tactics:

Digital natives: Shoppers comfortable with browser extensions, price tracking apps, and online research may increasingly reject promotional manipulation in favor of verified best prices.

Transparency expectations: Generations raised on social media exposés expect more honesty and are quicker to call out deceptive practices through viral content.

Experience over ritual: Some younger shoppers prioritize shopping convenience and speed over the treasure-hunt experience their parents enjoyed.

However, new vulnerabilities emerge around influencer marketing, social commerce, and FOMO-driven flash sales. The fundamental psychological principles—dopamine responses, scarcity effects, social proof—remain constant. Only delivery mechanisms evolve.

The likely outcome: Sophisticated hybrids

The future probably involves more retailers operating sophisticated hybrid strategies:

EDLP on transparent items: Competitive everyday pricing on commodity products where comparison is easy

Strategic promotions on differentiated products: Targeted discounts on unique, seasonal, or trend-driven merchandise where promotions create genuine value

Personalized offers: Data-driven individualized pricing rather than blanket promotional cycles

Dynamic pricing: Algorithm-adjusted prices responding to real-time market conditions

Membership models: Subscription-based pricing advantages (like Costco or Amazon Prime) creating EDLP-like benefits for committed customers

The most successful retailers will likely be those who use data and technology to optimize when to maintain stable pricing and when to deploy promotions—getting benefits of both approaches while minimizing downsides like margin erosion or broken customer trust.

How to identify genuine deals vs. fake sales

American retail's fundamental split between high-low promotional pricing and everyday low pricing reflects genuinely different philosophies about how to create customer value.

High-low pricing built empires for department stores by leveraging psychological principles—anchoring effects, dopamine hits, scarcity pressure, and deal-hunting identity. But it also created systematic incentives for deception, leading to $100+ million in legal settlements when "original prices" became complete fictions.

Everyday low pricing built Walmart into the world's largest company by offering consistent value, operational efficiency, and straightforward pricing that builds trust over time. But it requires enormous scale, superior cost structure, and willingness to sacrifice the excitement and margin flexibility that promotions provide.

The divide between high-low and EDLP will likely persist because different consumer segments want different experiences. What's changing is information access—shoppers increasingly have tools to verify whether promotional claims are genuine or manipulative, whether everyday prices truly are low or merely average.

In a market where some retailers need fake sales to survive, transparent pricing intelligence becomes essential. Understanding the strategies retailers deploy—and having tools to verify their claims—transforms you from target of manipulation into informed participant making genuinely optimal decisions.

Research methodology: This analysis draws on legal documents from 2011-2024 pricing lawsuits, academic research on retail pricing strategies and consumer psychology, business school case studies of JCPenney's pricing experiment and Walmart's EDLP evolution, and SimplyCodes' proprietary pricing data tracking patterns across 400,000+ retailers. All retailer fine print quotes reflect current website policies as of publication.

by Sean Fisher

AI Content Strategist · Demand.io

Sean Fisher is an AI Content Strategist at Demand.io, where he leads content initiatives and develops an overarching AI content strategy. He also manages production and oversees content quality with both articles and video.

Prior to joining Demand.io in September 2024, Sean served as a Junior Editor at GOBankingRates, where he pioneered the company's AI content program. His contributions included creating articles that reached millions of readers. Before that, he was a Copy Editor/Proofreader at WebMD, where he edited digital advertisements and medical articles. His work at WebMD provided him with a foundation in a detail-oriented, regulated field.

Sean holds a Bachelor's degree in Film and Media Studies with a minor in English from the University of California, Santa Barbara, and an Associate's degree in English from Orange Coast College.