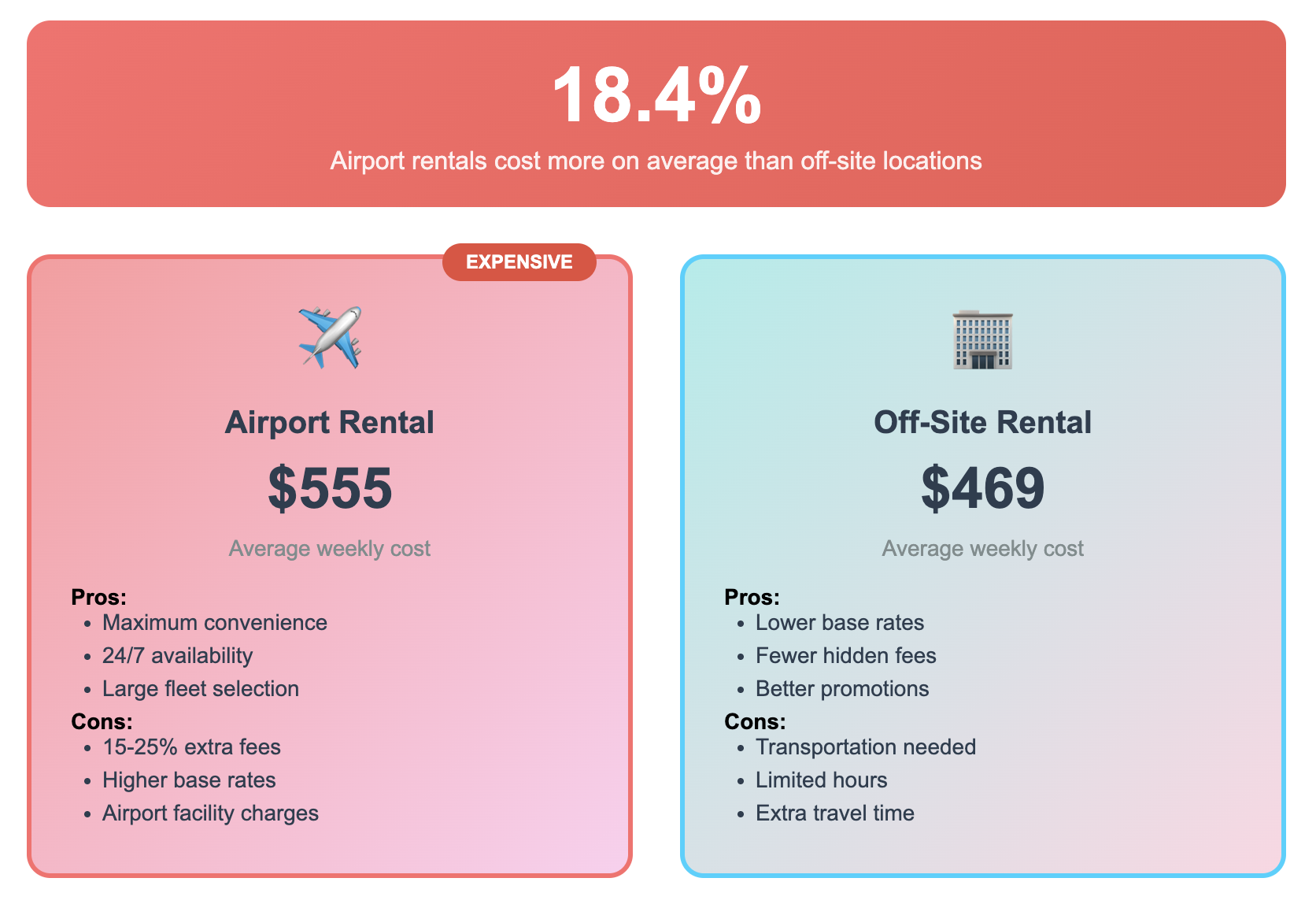

Airport rentals cost 18.4% more on average than off-airport locations, with weekly rentals averaging $555 at airports versus $469 downtown

Hidden fees and taxes add 15-25% to total rental costs at airports, with some extreme cases reaching 72% of the base rate

Los Angeles and San Francisco airports impose the steepest markups, with rates 30-50% higher than off-site locations

Peak season widens the airport premium gap, with Maui showing differences from $24/week in low season to $172/week in high season

Avis and Budget dominated promotional activity in fall 2023 with 39 and 30 codes respectively, but largely disappeared from promotional markets by 2024

Transportation costs to off-airport locations typically range from $10-60, making the math favorable for savings over $80

Airport rental car counters promise convenience but extract a significant price premium from travelers. SimplyCodes analyzed comprehensive 2024-2025 pricing data across major U.S. markets to decode exactly how much extra you pay for that convenience—and when the math favors making the trip to an off-airport location instead.

The data reveals a systematic pricing gap that extends far beyond simple base rates, driven by a complex web of airport-imposed fees, local taxes, and demand-driven premiums that can transform an advertised rate into a substantially higher final bill.

Looking for current rental car deals? Check out verified rental car promo codes to maximize your savings

Airport vs off-airport rental cars: Which one costs more?

The 18.4% airport premium: quantifying convenience costs

Comprehensive analysis of over 480 rental transactions across America's 15 busiest airports reveals the true cost of convenience. When comparing identical vehicles from the same companies, airport locations consistently charge 18.4% more than their off-airport counterparts, according to NerdWallet —a gap that translates to real money for travelers.

In practical terms, a typical week-long rental averages $555 at airport locations versus $469 at downtown branches, representing an $86 weekly premium, reported Islands, for the convenience of picking up your car steps from the terminal. This differential holds remarkably consistent across markets, with the premium appearing in nearly every city studied.

The consistency of this markup suggests it's not coincidental pricing but rather a systematic approach by rental companies to capitalize on the captive audience of airport travelers. Unlike customers who actively shop around for the best deal, airport renters often prioritize convenience and immediate availability over price comparison.

Seasonal variations amplify the gap

The airport premium isn't static—it fluctuates with demand patterns throughout the year. Peak travel seasons see the gap widen significantly, as airport locations experience greater demand surges than their off-site counterparts.

A detailed analysis of Maui rental markets illustrates this dynamic perfectly:

Low season (spring): Airport premium as small as $24 per week

High season (summer/holidays): Airport premium expanding to $172 per week

Average across five months: $94 weekly premium (31% higher than off-airport)

This seasonal elasticity means the decision to rent off-site becomes increasingly attractive during peak travel periods when absolute dollar savings reach their highest levels.

The hidden fee maze: understanding total cost impact

The advertised rate tells only part of the story. Airport-specific fees and taxes typically add 15-25% to the total rental cost, with some extreme cases reaching much higher percentages. These charges stem from airports charging rental companies for the privilege of operating on-site—costs that are passed directly to consumers.

Real-world fee breakdown analysis

A documented 8-day Budget rental from Denver International Airport provides a stark illustration of how fees can dwarf the base rate:

Base rate: $555.19

Final charge: Over $955

Fee differential: More than $400 (72% of base price)

Key fee components included:

Concession Recovery Fee: $77.74 (airport's operational cut)

Road Safety Surcharge: $19.17 (state-imposed)

Energy Recovery Fee: $7.11 (utility cost recovery)

Plus sales tax and additional local fees

While this represents an extreme example, it demonstrates how the "hidden" costs can potentially double your expected rental expense.

Common airport-specific charges

Unavoidable fees at most airport locations:

Airport Concession Recovery Fee: 10-15% of base rate

Customer Facility Charges: $10-20 flat fee or ~10% additional

Local tourism taxes: Variable by destination

Vehicle license fees: Typically $5-15

For example, San Francisco International Airport imposes a mandatory $16.50 facility fee per rental contract—unavoidable if you rent at SFO's on-site rental center.

Regional variations: cities with the steepest airport markups

Courtesy of LAX

Courtesy of LAXWhile airport premiums exist nationwide, certain markets impose particularly punitive pricing differences. Major hubs and high-demand tourist destinations typically show the largest gaps between airport and off-site pricing.

Highest markup markets

Top tier airport premiums (30-50% higher than off-site):

Los Angeles (LAX): Weekly rates averaging $593 airport vs. $393 off-site (nearly $200 difference)

San Francisco (SFO): Over 40% premium due to high facility charges and local demand

Houston, Phoenix, Atlanta, Seattle: Typically 25-30% more expensive at airports

These markets combine high operational costs, significant tourist demand, and aggressive local fee structures to create the perfect storm for elevated airport pricing.

Market anomalies: where off-site costs more

Interestingly, not every market follows the typical pattern. Several locations show inverted pricing where off-airport can be more expensive:

New York City (Manhattan): Downtown rental offices often charge "premium location" fees of ~17%, making JFK Airport potentially cheaper

Las Vegas Strip: Tourist-centric pricing can exceed airport rates

Dallas-Fort Worth: Nearly no difference between airport and off-site pricing

These anomalies highlight the importance of comparing both options for your specific destination rather than assuming airport locations are always more expensive.

Transportation cost trade-offs: when off-site makes sense

The decision to rent off-site requires balancing potential savings against transportation costs and convenience factors. Most travelers find the math favors off-site rental when savings exceed $80 and transportation costs remain under $30.

Favorable off-site scenarios

High-value situations for off-airport rental:

Public transit access: Denver airport train ($10) to downtown rental saves $150+ on weekly rentals

Hotel shuttles: Free transportation eliminates additional costs entirely

Extended rentals: Week-long or longer periods amplify savings benefits

Multiple-day hotel stays: Avoid $30-50 daily hotel parking fees during non-driving days

When airport convenience wins

Situations favoring airport pickup despite higher costs:

Late-night arrivals: Off-site agencies often have limited hours

Heavy luggage: Transportation becomes more challenging and expensive

Short rentals: 1-2 day rentals may not justify transportation time and cost

Specialty vehicles: Airports maintain larger fleets for immediate availability

Tight schedules: Time constraints make convenience worth the premium

Break-even analysis

Transportation cost comparison:

Rideshare to downtown: Typically $20-40 each way

Public transit: Usually $5-15 per person

Taxi service: $30-60 depending on distance

Hotel shuttle + local transit: Often under $20 total

Rule of thumb: If weekly savings exceed $100 and transportation costs stay under $40 round-trip, off-site rental typically provides better value.

Promotional code patterns reveal market strategies

SimplyCodes data on rental car promotional activity from September 2023 through July 2025 reveals interesting patterns in how major brands approach discount strategies, particularly in relation to airport versus off-site pricing.

Major brand promotional strategies

Avis promotional pattern analysis:

Peak promotional period: September 2023-February 2024 (58 total codes)

Sharp decline: March-August 2024 (only 1 code released)

Moderate recovery: September-October 2024 (16 codes)

Current state: Minimal promotional activity since November 2024

Budget's similar trajectory:

Active period: September 2023-February 2024 (34 total codes)

Virtual silence: March-August 2024 (only 2 codes)

Brief resurgence: September-October 2024 (11 codes)

Current dormancy: Extremely limited activity since November 2024

Enterprise and Hertz: different approaches

Enterprise's steady approach:

Consistent low-volume promotional activity (1-5 codes monthly)

No dramatic swings in promotional intensity

Recent uptick: More active in early 2025 than competitors

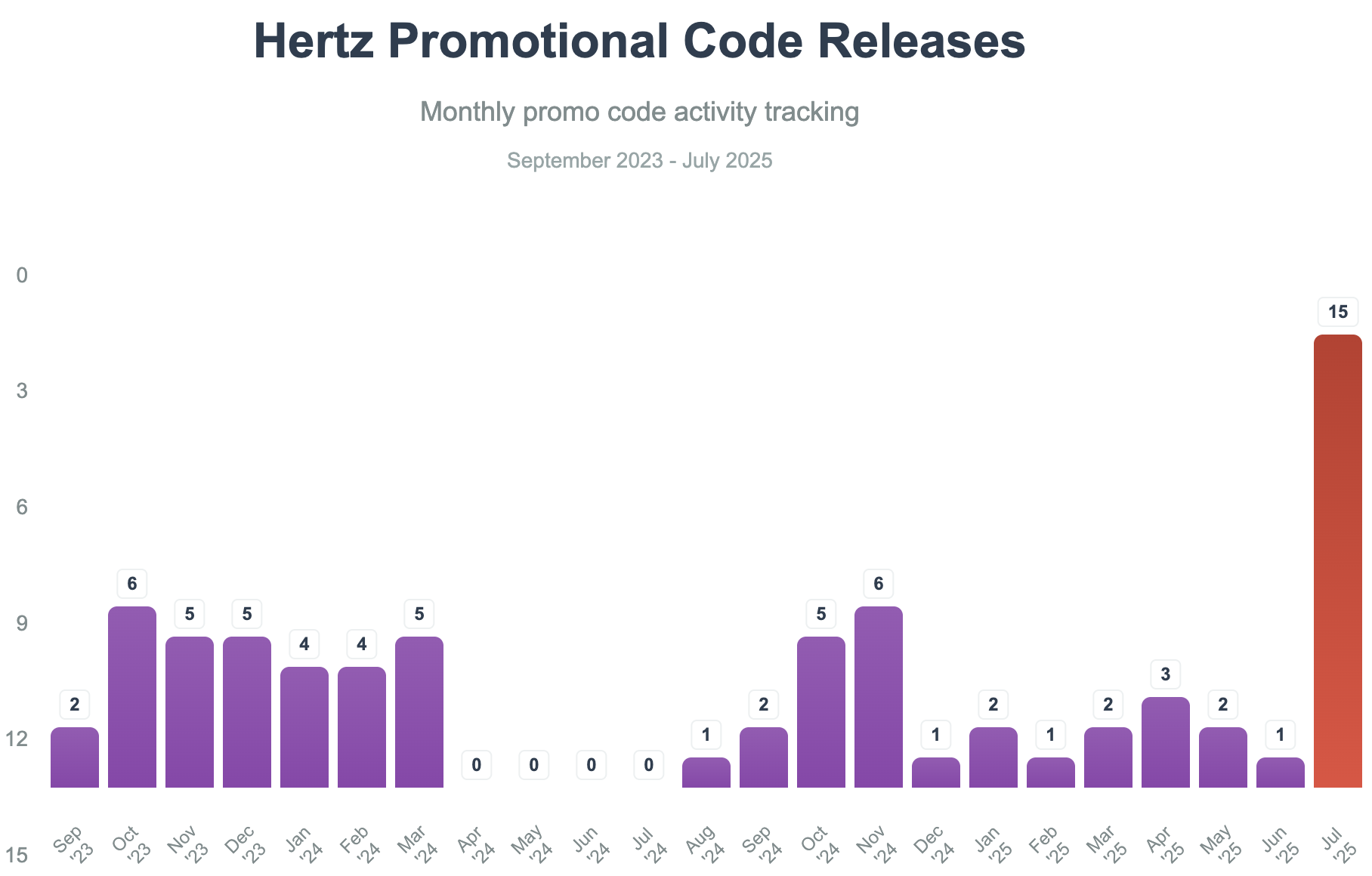

Hertz's strategic timing:

Dramatic surge: July 2025 with 15 promotional codes

Moderate but consistent background activity

Strategic seasonal focus: Higher activity during traditional travel periods

Promotional timing insights

The data suggests rental car companies significantly reduced promotional activity during 2024's middle months, potentially indicating:

Supply-demand balance: Less need for promotional pricing during peak travel recovery

Margin protection: Focus on maintaining profitability over market share

Inventory management: Reduced need to stimulate demand during busy periods

Strategic implication: Travelers may find better promotional opportunities during traditional "shoulder seasons" when companies resume more aggressive discount strategies.

Best practices for maximizing rental car savings

Based on comprehensive pricing analysis and promotional patterns, strategic renters can optimize their approach to minimize total rental costs while maintaining reasonable convenience.

Timing optimization strategies

Seasonal considerations:

Book off-season: Greatest price flexibility and promotional activity

Avoid peak periods: Summer and holiday travel show maximum airport premiums

Monitor shoulder seasons: Spring and fall often provide optimal value

Advance booking benefits:

Price protection: Lock in rates before peak season increases

Promotional access: Early booking often captures better discount codes

Inventory availability: Ensure preferred vehicles at off-site locations

Location selection framework

High-savings scenarios for off-site rental:

Major hubs with transit access: Denver, San Francisco, Seattle

Extended stays: Week-long or longer rentals

Multiple destinations: When you won't need the car immediately

Airport rental advantages:

Short stays: 1-3 day rentals with immediate needs

Late arrivals: After-hours pickup requirements

Specialty needs: Specific vehicle types or immediate availability

Promotional code optimization

Based on SimplyCodes rental car data:

Monitor seasonal patterns: Highest promotional activity typically September-February

Check multiple brands: Enterprise and Hertz show different promotional cycles than Avis/Budget

Combine strategies: Use promotional codes with off-site rental for maximum savings

2025 rental car market outlook

Looking ahead to the remainder of 2025, several trends suggest continued evolution in rental car pricing strategies and the airport premium gap.

Predicted pricing patterns

Airport premium trends:

Continued differentiation: Airport convenience premiums likely to persist at 15-20% levels

Seasonal volatility: Peak season gaps may widen further as travel demand remains strong

Fee structure evolution: Additional airport-imposed charges possible as facilities seek revenue

Promotional activity forecast:

Return to competitive discounting: 2024's promotional drought may reverse as market matures

Strategic timing: Expect increased promotional activity during traditional slower periods

Brand differentiation: Continued divergence in promotional strategies between major brands

Technology and market changes

Digital optimization trends:

Mobile check-in expansion: Reducing airport counter friction while maintaining premiums

Dynamic pricing adoption: More sophisticated demand-based pricing across all locations

Loyalty program evolution: Enhanced benefits to justify premium pricing

Competitive landscape shifts:

Market consolidation effects: Fewer major players may reduce pricing pressure

Alternative mobility options: Rideshare and car-sharing creating new competitive dynamics

Electric vehicle integration: Premium pricing for EV options across all locations

Strategic recommendations for 2025 travelers

For maximum savings:

Compare total costs including all fees and transportation expenses

Consider rental duration - longer stays favor off-site locations

Monitor promotional cycles - watch for seasonal promotional activity returns

Book early during peak seasons when airport premiums reach maximum levels

Use public transit where available to access off-site locations cost-effectively

For convenience optimization:

Factor in arrival times and off-site agency hours

Consider luggage and group size when evaluating transportation options

Assess immediate vehicle needs versus delayed pickup scenarios

Evaluate total trip logistics including hotel proximity and parking costs

The rental car market's airport premium remains a consistent factor in travel costs, but strategic planning can minimize its impact while maintaining reasonable convenience. As the industry continues evolving through 2025, informed travelers who understand these pricing dynamics will be best positioned to optimize their rental car decisions.

How we analyze this data: Rental car pricing data sourced from comprehensive market analysis of major U.S. airports and off-site locations. Promotional code data from SimplyCodes' proprietary database tracking over 400,000 retailers. All pricing comparisons include total costs with fees and taxes.

Ready to save on your next rental? Find current rental car promo codes and compare deals across all major brands.

by Sean Fisher

AI Content Strategist · Demand.io

Sean Fisher is an AI Content Strategist at Demand.io, where he leads content initiatives and develops an overarching AI content strategy. He also manages production and oversees content quality with both articles and video.

Prior to joining Demand.io in September 2024, Sean served as a Junior Editor at GOBankingRates, where he pioneered the company's AI content program. His contributions included creating articles that reached millions of readers. Before that, he was a Copy Editor/Proofreader at WebMD, where he edited digital advertisements and medical articles. His work at WebMD provided him with a foundation in a detail-oriented, regulated field.

Sean holds a Bachelor's degree in Film and Media Studies with a minor in English from the University of California, Santa Barbara, and an Associate's degree in English from Orange Coast College.