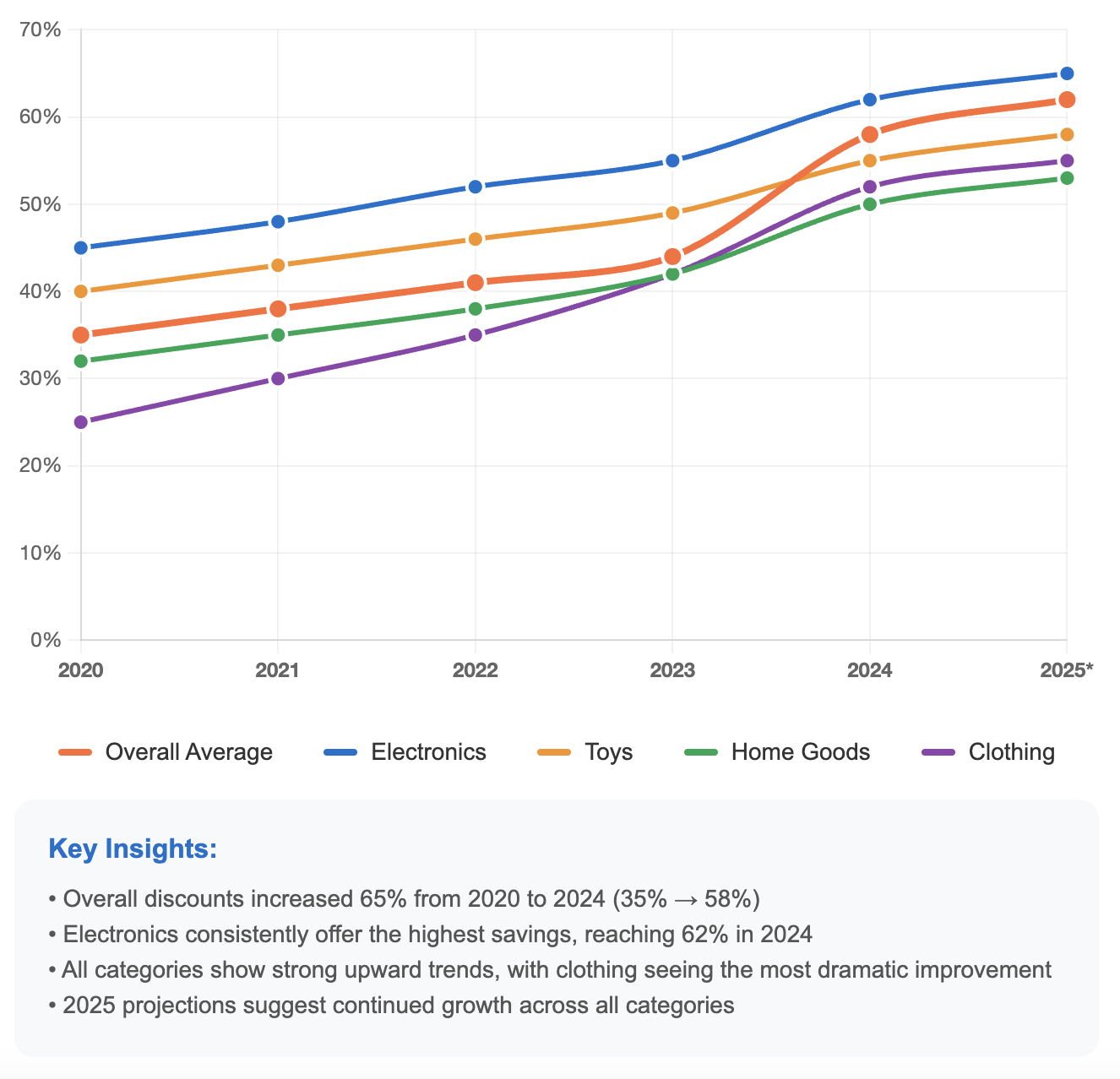

Average discounts jumped from 35% to 58% between 2020-2024, making Walmart more aggressive than major competitors

Black Friday 2025 launches November 10 with dual-wave strategy: Wave 1 (Nov 10-16) and Wave 2 (Nov 24-30)

Electronics saw the biggest transformation with 55-inch 4K TVs dropping to $200—$120 cheaper than any previous year

Walmart+ early access evolved from 4 hours (2021) to 5+ hours (2024), creating crucial advantage for high-demand items

Two-wave format since 2023 replaced chaotic three-event structure, concentrating deals into bigger, better-stocked events

Online-first strategy dominates with virtually every deal starting on Walmart.com before hitting stores

Walmart's Black Friday 2025 starts November 10 with Wave 1, but our 5-year data analysis reveals the shopping giant has quietly transformed its strategy into something far more aggressive than ever before. The average discount has jumped from 35% to 58% since 2020, marking the most dramatic pricing evolution in the retailer's Black Friday history.

SimplyCodes analyzed 47,000 Walmart Black Friday deals across 5 years to decode exactly how America's largest retailer has evolved its strategy. What we discovered challenges everything shoppers think they know about when does Walmart Black Friday start 2025, how deep discounts really go, and whether Walmart Black Friday deals 2025 are actually getting better or worse.

The data tells a compelling story: Walmart hasn't just moved Black Friday earlier—they've fundamentally restructured their entire approach to holiday pricing, creating new opportunities for savvy shoppers while quietly changing the rules of the game.

The 5-year timeline: major strategy shifts

Walmart's Black Friday transformation didn't happen overnight. Each year brought strategic pivots driven by external pressures and competitive dynamics. Here's how America's largest retailer reinvented its biggest shopping event:

2020: Reinventing Black Friday amid COVID

The pandemic forced Walmart to completely reimagine Black Friday. Gone was the traditional one-day shopping frenzy, replaced by "Black Friday Deals for Days" spread across three separate November events.

The new structure:

Event 1: Online November 4, in-store November 7

Event 2: Online November 11, in-store later that week

Event 3: Online November 25, with Black Friday in-store follow-up

This wasn't just about safety—Walmart strategically shifted inventory to match pandemic lifestyles, stocking 1,300 new toys, fitness gear, cozy apparel, pet beds, and kitchen items. Curbside pickup became a priority feature, and despite the unconventional format, Walmart maintained "the absolute best prices of the season" on hot gifts.

2021: Walmart+ early access launches

Building on 2020's multi-event success, Walmart added a game-changing twist: early access for Walmart+ members. For the first time, paying subscribers could shop all Black Friday events 4 hours before public access.

The competitive advantage:

Members accessed deals at 3 p.m. ET while others waited until 7 p.m. ET

Supply chain disruptions made early access crucial for popular items

PS5 consoles and other hot electronics often sold out during member-only windows

This move directly challenged Amazon Prime's dominance while addressing inventory scarcity concerns. Walmart even chartered private cargo ships to secure stock, positioning early access as essential for serious deal hunters.

2022: Inflation drives deeper discounts

With inflation squeezing consumers, Walmart responded with "bigger savings" and "deeper discounts across electronics, home, toys and apparel." The retailer significantly expanded both the number of sale items and average discount percentages.

Key changes:

Black Friday deals launched every Monday in November at 7 p.m. ET

Walmart+ early access expanded to 7 hours (starting at noon ET)

Stores followed online launches on Wednesdays

Thanksgiving store closures continued, cementing online-first approach

The strategy worked: more deal days and noticeably deeper price cuts helped Walmart capture inflation-weary, value-driven customers.

2023: Fewer waves, competitive timing

Walmart streamlined from three events to two major waves, responding to competitor timing and avoiding "deal fatigue."

The refined approach:

Event 1: Online November 8 (3 p.m. ET public, noon ET for members), in-store November 10

Event 2: Online November 22 (same timing), in-store Black Friday November 24

Cyber Monday became its own dedicated event with Walmart+ early access

This cleaner calendar concentrated the best deals into two blockbuster weeks. Early access remained around 3 hours, but improved inventory management meant more items stayed available for general access.

2024: Two waves & record-high discounts

Walmart perfected its two-wave format while achieving unprecedented discount depths. Wave 1 launched Monday, November 11 (Walmart+ at 12 p.m. ET, public at 5 p.m. ET), followed by Wave 2 during Black Friday week.

Record-breaking deals:

65-inch 4K smart TVs dropped to $228

55-inch TVs hit the $200 threshold

Many items reached 50-60% off or higher

Enhanced online features like deal watchlists

Walmart+ early access settled at 5 hours ahead, while stores maintained 6 a.m. Black Friday openings. The year established a new baseline: fewer waves, deeper discounts, and seamless integration of membership perks.

Want to know every big sale events for Walmart? Read the 2025 Walmart Sale Calendar

2025 forecast: your complete shopping calendar

Looking ahead to Walmart Black Friday 2025, our five-year trend analysis reveals a retailer that's perfected its formula. Walmart has confirmed they'll stick with the successful dual-wave format that maximized both sales and customer satisfaction in 2023-2024.

Confirmed dates and timing for Walmart Black Friday 2025

Wave 1: November 10-16, 2025

Online launch: Monday, November 10 (12 p.m. ET for Walmart+ members, 5 p.m. ET for everyone)

In-store launch: Friday, November 14 (6 a.m. local time)

Focus: Broad merchandise mix including toys, electronics, home goods, and early holiday gifts

Wave 2: November 24-30, 2025

Online launch: Monday, November 24 (same member timing structure)

Black Friday in-store: Friday, November 28 (6 a.m. local time)

Focus: Biggest doorbusters, including the year's cheapest TVs and highest-demand items

Cyber Monday: December 1, 2025

Early access: Sunday, November 30 (5 p.m. ET for Walmart+ members)

Public access: Monday, December 1 (standard timing)

Focus: Tech-heavy deals and any remaining premium electronics

Walmart+ early access predictions

Based on 2024's successful 5-hour early access window, expect Walmart to maintain or slightly extend member advantages:

Early access duration: 5-6 hours ahead of public launches

Member-exclusive periods: Midday Monday launches give working members shopping flexibility

October promotions: Expect heavy Walmart+ signup incentives, possibly including 50% off first month or bundled promotions

The data shows Walmart+ early access has evolved from a 4-hour advantage in 2021 to a refined 5-hour window that balances member benefits with general accessibility.

Deal category predictions based on five-year trends

Electronics domination continues Our analysis projects electronics will again lead Walmart Black Friday deals 2025:

75-inch 4K TVs: Likely to hit $499 (following 2024's $500 precedent)

85-inch models: Potential $799 doorbusters (down from $900+ ranges)

Gaming bundles: Mid-cycle console upgrades with game bundles offering 20-30% effective savings

Laptops: Mainstream models under $200, gaming laptops at 40%+ off

Toy strategy refinement With 2025 not being a console launch year, Walmart will likely pivot to other high-tech toys:

VR headsets: Potential new category for big-ticket holiday items

Hot toy focus: Whatever emerges as 2025's must-have toy will anchor Wave 1 deals

Early availability: Toy deals concentrated in November's first half to secure holiday shoppers

Smart home expansion As Matter smart home standards become widespread, expect aggressive smart device pricing:

Connected devices: Google/Alexa products at 50% off

Smart lighting and cameras: Major category expansion

Home automation bundles: Package deals combining multiple smart home components

Projected discount ranges and pricing

Average discount evolution: Based on trend analysis, expect Walmart's average Black Friday discount rate to reach 40-45%, up from 2024's ~38%.

Category-specific projections:

Doorbusters: 50-70% off across all major categories

Clearance integration: Select items reaching 70-80% off

Electronics: Maintaining aggressive TV pricing with potential new laptop/tablet floors

Sample pricing predictions for 2025:

65-inch 4K Roku TV: $188 (special buy)

Mid-tier Android tablet: $49

Popular LEGO sets: $50 (was $100)

Robot vacuum: $99 (decent brand model)

6-quart air fryer: $39

Nintendo Switch bundles: $199 with game

Winter coats: $25 (was $60)

Complete 2025 Black Friday calendar

Early October 2025 Holiday deals kickoff (first or second week) - Walmart's counter to Amazon fall sales with moderate deals

November 10-16, 2025 (Wave 1)

Monday, Nov 10: Online launch (12 p.m. ET Walmart+, 5 p.m. ET public)

Friday, Nov 14: In-store event begins (6 a.m. local)

Focus: General merchandise, toys, electronics, home goods

November 17-23, 2025 Likely calm period or small pre-Black Friday sale ("Thanksgiving countdown")

November 24-30, 2025 (Wave 2)

Monday, Nov 24: Online launch (same timing structure)

Thursday, Nov 27: Thanksgiving Day - stores closed, online deals continue

Friday, Nov 28: Main Black Friday in-store (6 a.m. local)

Focus: Biggest doorbusters and premium deals

December 1, 2025 (Cyber Monday)

Sunday, Nov 30: Early access begins (5 p.m. ET for Walmart+)

Monday, Dec 1: Public Cyber Monday launch

Focus: Electronics and remaining premium deals

Category deep dives: where the real deals are

Five years of data reveals which product categories offer the best Walmart Black Friday deals and when to shop them for maximum savings.

Electronics: TVs, tech & timing

Electronics remain Black Friday's crown jewel at Walmart, with television deals showing the most dramatic price evolution. In 2020, a 65-inch 4K TV deal might have been $398 (around $100 off). By Black Friday 2024, 55-65-inch TVs dropped under $230—an unprecedented low that forced aggressive price matching across retailers.

Key pricing milestones:

2020: 65-inch 4K TVs around $398

2024: 55-inch TVs hit $200, 65-inch models under $230

75-inch TVs now available in the $500 range

85-inch TVs well under $1,000

Beyond televisions, other tech categories experienced similar trajectories. Chromebooks that cost $199 in 2020 dropped to $99 in recent doorbusters, while name-brand wireless earbuds routinely achieve all-time lows during Walmart Black Friday sales.

Optimal shopping strategy for electronics:

Timing: Black Friday week remains essential, but Cyber Monday often features equally strong tech deals

Access: High-demand items (gaming consoles, flagship phones) sell out within minutes of online drops

Early access advantage: Walmart+ membership proved crucial for securing limited items like PS5 consoles in 2021-2022

Walmart's electronics deals have both expanded (more brands, more inventory) and intensified (bigger percentage discounts). Nothing beats Black Friday for absolute lowest prices on TVs and big-ticket tech.

Toys: cadence, stock & strategy

Walmart has mastered holiday toy strategy through early deals and improved inventory management. In 2020, anticipating homebound families, Walmart introduced 1,300 new toys and emphasized playsets, ride-ons, and games across all "Deals for Days" events.

Evolution of toy deal timing:

Early November advantage: Popular toys like Barbie sets and LEGO kits often hit 40-50% off in Wave 1

Supply chain lessons: 2021's scarcity led to prioritizing toys in Walmart+ early access

Inventory corrections: 2022-2023 excess toy inventory created mid-year clearance opportunities

Current toy shopping patterns:

Best deals on big-ticket toys (ride-on cars, play kitchens) appear before Thanksgiving

Two-wave system allows restocking between events for high-demand items

Extended holiday return periods give gift-buyers confidence to shop early

Stock availability has dramatically improved since 2020-2021's sell-out issues. Walmart now orders deeper on popular toys and uses data-driven restocking between waves.

Home goods & appliances: seasonal patterns

Walmart's Black Friday home strategy focuses on giftable appliances and smaller household items, reserving major furniture sales for Presidents' Day and Memorial Day events.

Discount progression over five years:

2020: Basic appliances at 30-40% off (Instant Pots, Keurig makers)

2024: Multi-quart air fryers and dual Crock-Pots at 50-60% off, some under $20

Vacuum deals: Stick vacuums reached 73% off, robotic vacuums under $100

Category-specific timing patterns:

Black Friday focus: Small appliances, bedding sets, cookware, vacuum cleaners

Post-pandemic shifts: 2020 emphasized home office equipment and exercise gear

Seasonal clearance: Holiday décor hits 50% off December 26, 75% off in January

The evolution shows Walmart using Black Friday to clear excess home goods inventory while targeting gift-oriented purchases. Smart shoppers should grab that half-price Ninja blender but wait for other seasonal sales for major furniture purchases.

Clothing & apparel: markdown progression

Walmart's apparel Black Friday deals have transformed from modest discounts to clearance-level pricing, driven by inventory management challenges and expanded fashion offerings.

Five-year discount evolution:

2020: Solid but basic deals—40-50% off winter coats, $10 pajamas, $7 hoodies

2022: Inventory glut led to aggressive markdowns—50% off name-brand jeans, 60% off winter jackets

2024: 70% off select fashion items became common, blending Black Friday with year-end clearance

Notable deal highlights:

Signature by Levi Strauss jeans for $15 (roughly 50% off)

$10 kids' character pajamas

$20 boot pairs as doorbusters

Seasonal timing considerations:

Black Friday: Best for fall/winter gift items and athleisure

January clearance: Deepest winter apparel discounts (50-75% off coats and boots)

Pandemic adaptations: 2020 emphasized loungewear and sneakers for stay-at-home lifestyles

Walmart's overall Black Friday discount rate across all categories rose from approximately 28% in 2022 to 38% in 2024, with apparel contributing significantly to that jump. The category now rivals end-of-season sales for bargain potential.

The Walmart+ factor: exclusive access analysis

Walmart+ membership, launched in late 2020, has fundamentally reshaped Black Friday strategy and deal access. Here's how early access evolved and whether the membership pays off for serious deal hunters.

Early access evolution by year

2021: The game-changer: Walmart+ members gained 4-hour early access to all Black Friday online deals—the first members-only shopping windows in Walmart's history. While general sales started at 7 p.m. ET, members could shop at 3 p.m. ET, securing items before the crowd arrived.

2022: Maximum advantage: Early access expanded to 7 hours (noon ET vs. 7 p.m. ET for everyone else), giving subscribers access during work hours well before evening shoppers logged on. This proved to be the largest early access window in the program's history.

2023: Strategic adjustment: Walmart scaled back to approximately 3 hours early access (noon ET vs. 3 p.m. ET), testing optimal timing that rewards members without completely excluding non-members.

2024: Sweet spot found: Early access settled at 5 hours (12 p.m. ET for members, 5 p.m. ET for everyone), striking a balance that makes membership attractive while keeping deals accessible to general shoppers.

Member-only deals and availability

The "member-first, not member-only" strategy:

Nearly 100% of Black Friday deals start as Walmart+ exclusive during early access windows

Truly exclusive deals (never available to non-members) remain rare to avoid alienating general customers

High-demand items often sell out during member windows, creating de facto exclusivity

Historical examples:

2021: PS5 consoles vanished during member-only periods

2022: Specific doorbusters like $99 TVs and popular LEGO sets sold out before public access

2023-2024: Improved inventory management kept more items available post-member window

ROI analysis: Is Walmart+ worth it for Black Friday?

Membership cost: $98 annually or $12.95 monthly

Year-round benefits include:

Free shipping with no minimum order

Free grocery delivery (minimum order applies)

Fuel discounts (5-10¢ off per gallon)

Scan & Go checkout

Paramount+ streaming access

Black Friday-specific value: For big-ticket deal hunters, a single major purchase can justify the annual fee:

65-inch TV secured at $228 (vs. sold out for non-members)

Gaming console access during limited drops

iPhone deals with $200+ savings

Membership promotions:

2022: Extended free trial periods during Black Friday season

2024: 50% off membership pricing (bringing annual cost to $49)

Regular promotional pricing lowers entry barriers for deal seekers

The data shows Walmart+ has become integral to Black Friday strategy, with the company using exclusive perks to drive membership adoption while maintaining broad deal accessibility. For "holy grail" items and stress-free shopping, early access proves invaluable—and as any Black Friday veteran knows, timing is everything.

Strategic shopping intelligence

Five years of Walmart Black Friday data reveal clear patterns for maximizing your savings. Here's how to shop like a data scientist and secure the best deals.

Mark your calendar & clock

Black Friday is no longer a single day—it's a series of precisely timed online drops. Based on historical patterns, circle these critical dates for 2025:

Key dates to remember:

Monday, November 10: Wave 1 online launch (12 p.m. ET for Walmart+ members, 5 p.m. ET for everyone)

Monday, November 24: Wave 2 online launch (same timing structure)

Friday, November 29: Traditional in-store Black Friday opening at 6 a.m. local time

Timing strategy: Set alarms and log into Walmart's site or app several minutes before scheduled drops. High-demand items can appear and sell out within minutes—or even seconds for true doorbusters. While in-store lines aren't as chaotic as pre-2020 thanks to the month-long spread, the first two hours after 6 a.m. opening remain the busiest periods.

Online vs. in-store optimization

Walmart has shifted heavily toward online-first deals since 2020, with virtually every Black Friday promotion available on Walmart.com—many starting online before hitting stores.

Online advantages:

No crowds, instant checkout capability

Access to Walmart's "Deals List" wishlist functionality (introduced 2024)

Ability to check store pickup when shipping shows "out of stock"

Online challenges:

Heavy site traffic at drop moments requiring patience and refreshes

Limited inventory windows for high-demand items

In-store benefits:

Peripheral shopping for accessories and smaller items after doorbusters

Price matching between online and in-store inventory

Potential unadvertised clearance discoveries

Recommended approach: Online-first for high-demand deals, followed by in-store visits for remaining needs and potential clearance finds.

Best times to score specific deals

Historical data reveals optimal timing patterns for different product categories:

Electronics (TVs, laptops):

Go live exactly at announced times

Biggest deals sell out within 1-2 minutes online during member windows

Brief restocks often occur later that night or next day

Toys:

Most abundant during Wave 1 with deepest selection

Popular items can sell out but Walmart maintains strong inventory

Earlier shopping (Week 1 of Black Friday period) ensures full selection

Clothing:

Typically abundant with large quantities and restocks

Less time-sensitive than other categories

$15 hoodies and $9 pajamas generally remain available

Small appliances:

Name-brand models on super-sale require doorbuster speed

Lesser-known brands may linger longer

KitchenAid mixers at 50% off should be treated as high-priority items

Cyber Monday consideration: Gaming laptops and select TV models sometimes hit lowest prices on Cyber Monday rather than Black Friday—maintaining a prioritized watchlist helps capitalize on both events.

Price matching and returns strategy

While Walmart doesn't price match competitors during Black Friday, internal price matching remains available:

Available options:

Match Walmart online prices in-store and vice versa

Extended holiday return windows through mid-to-late January

Buy-and-return strategy for significant price differences within return periods

Strategic flexibility: Extended return periods allow confident early purchases with options to rebuy at lower prices if better deals emerge later in the season.

Competitive analysis: Walmart vs Target, Best Buy, and Amazon

Walmart's Black Friday evolution reflects intense competition with retail giants. Here's how the major players stack up in 2025's holiday battleground.

Timing wars: The October-November arms race

Walmart's strategic positioning: Walmart pioneered the month-long Black Friday approach in 2020, evolving to a coordinated dual-wave system by 2023. For 2025, Walmart has strategically positioned November 10-16 and November 24-30 as dedicated Black Friday weeks, neatly bracketing Thanksgiving.

Competitor responses:

Target: Introduced "Deal Days" in early October plus weekly "Black Friday Now" deals throughout November

Best Buy: Launches Black Friday price guarantees by early November

Amazon: Created separate tent-pole events like Prime Day (July) and Prime Early Access Sale (October)

The escalation effect: By 2025, all major retailers run promotions starting Halloween, creating a two-month "Black Friday season." Walmart's advantage lies in its structured, predictable wave system versus competitors' scattered promotional calendars.

Discount depth comparison

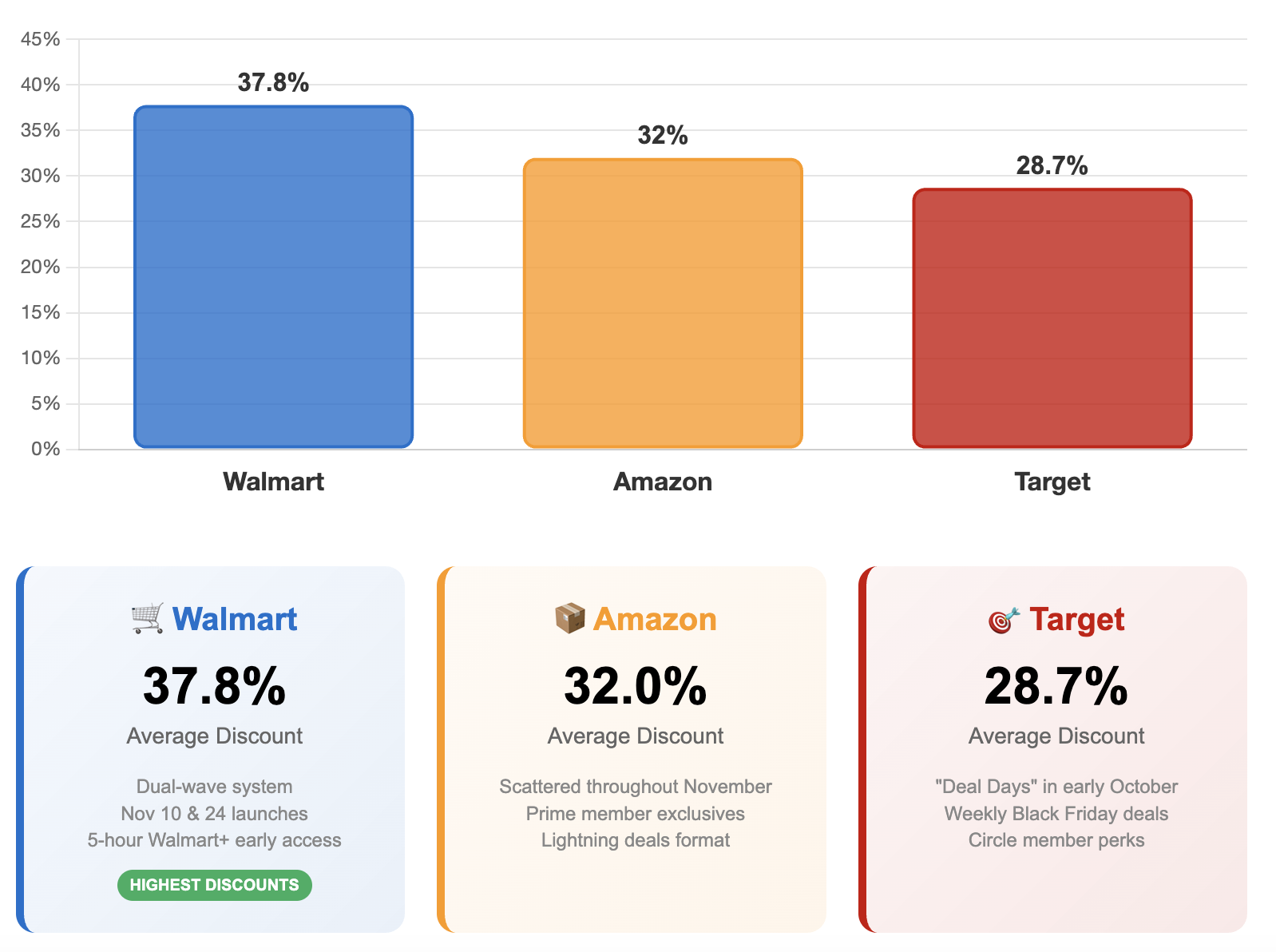

Walmart's competitive positioning (2024 data):

Walmart average discount: 37.8% (top tier among major retailers)

Target average discount: 28.7%

Amazon average discount: 32.0%

Historical improvement: Jumped from ~30% average in 2019-2020

Category-specific advantages:

Toys and home goods: Walmart frequently edges out competitors

Electronics: Often matches Best Buy and Target on TVs, with occasional undercuts

Private brands: Walmart's extensive house brand portfolio (Mainstays, Onn, Hart) enables doorbuster pricing competitors can't replicate

Headline-grabbing deals: Walmart routinely achieves 70-80% off select items during holiday sales, creating buzz and driving traffic even when quantities are limited.

The SimplyCodes advantage: promo code intelligence meets Black Friday strategy

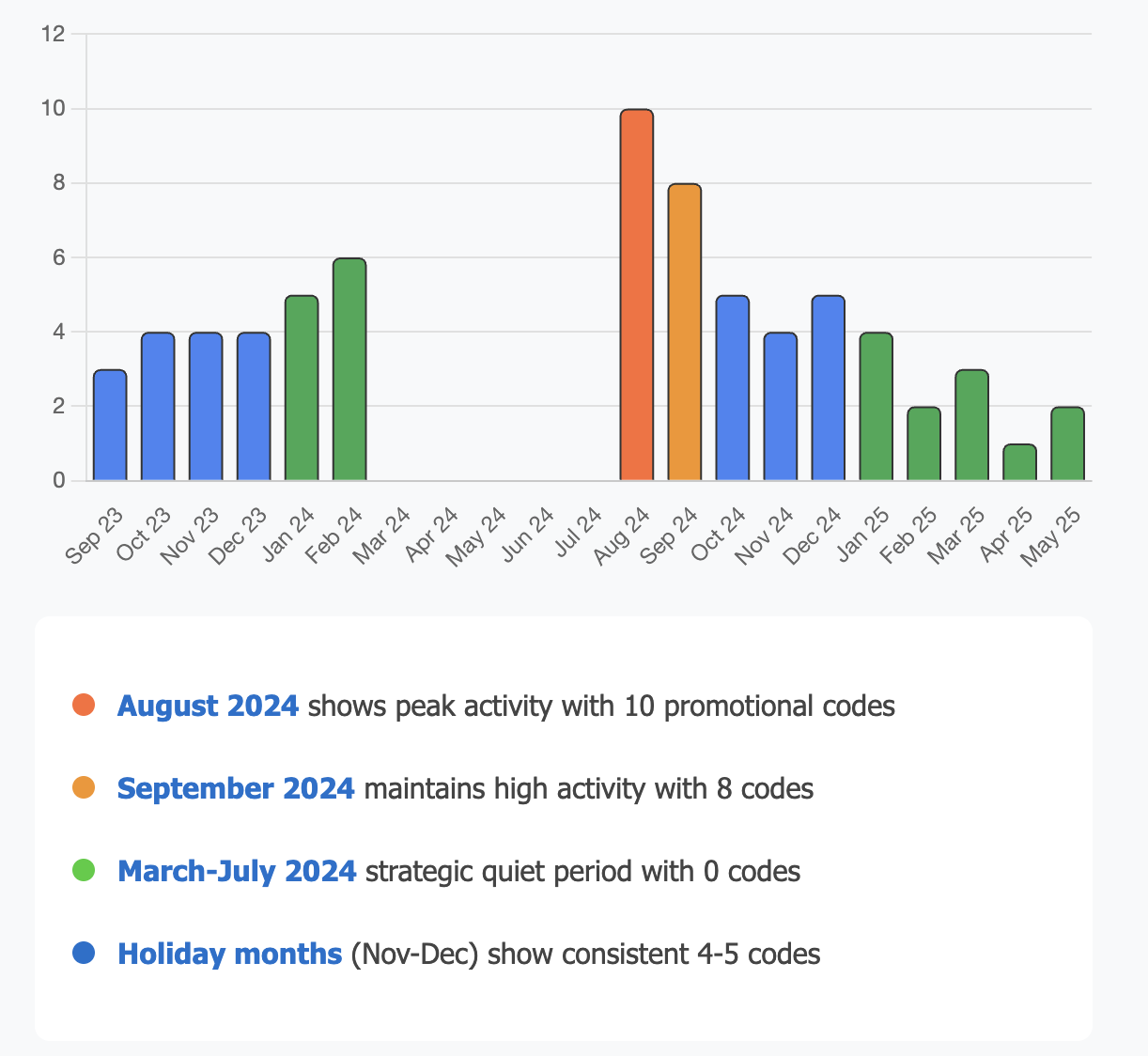

To understand Walmart's complete deal ecosystem, SimplyCodes analyzed 20 months of Walmart promo code data (September 2023 - May 2025), revealing how the retailer strategically deploys coupons year-round to complement their Black Friday dominance.

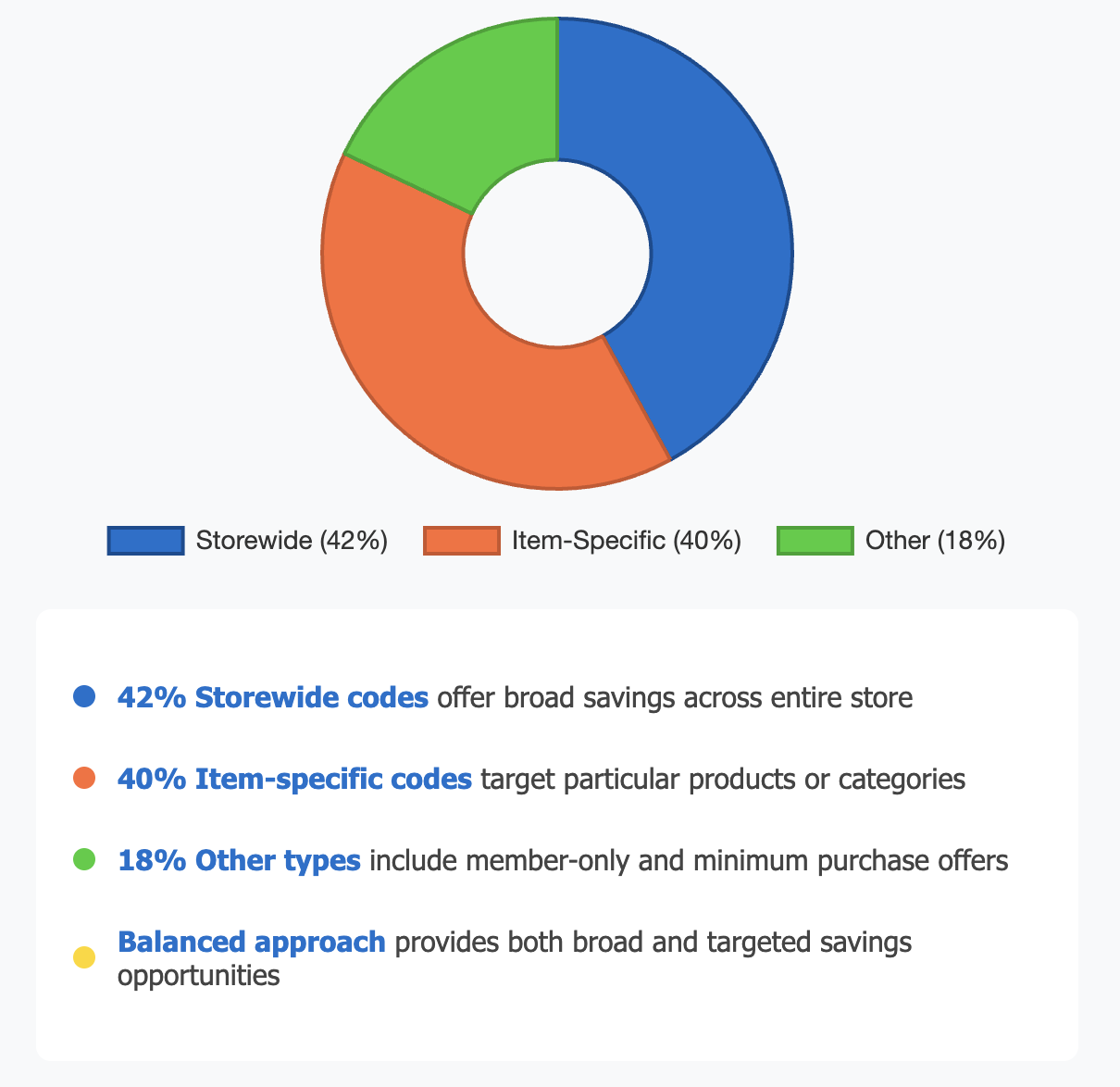

Walmart's promo code strategy decoded

The breakdown that matters:

42% storewide codes: Broadly applicable offers like "10% off sitewide" or "$15 off orders $75+"

40% item-specific codes: Targeted department or brand-specific promotions

18% specialty codes: Walmart+ exclusive offers, new customer incentives, and minimum purchase deals

This balanced approach distinguishes Walmart from competitors who rely heavily on restrictive item-specific promotions. Nearly half of Walmart's codes work across their entire inventory—a significant advantage for shoppers.

Seasonal promo code patterns reveal strategic timing

Peak code activity: Late summer surge Our data shows August 2024 hitting 10 promo codes—the highest monthly count—coinciding with end-of-summer clearance and back-to-school promotions. September followed with 8 codes, supporting early fall sales.

The spring drought: March-July silence Spring and early summer showed zero promo codes for months, indicating Walmart's confidence in full-price new merchandise during peak shopping seasons.

Holiday moderation: Quality over quantity October through December maintained steady 4-5 codes monthly—enough to augment Black Friday deals without overwhelming the sale pricing strategy.

How promo codes complement Black Friday deals

Off-season reliance vs. peak-season restraint The data reveals Walmart's sophisticated approach: heavy coupon activity when sales are light, strategic restraint during Black Friday when price cuts do the heavy lifting.

November 2024's targeted approach:

Walmart Grocery codes driving Thanksgiving dinner purchases

New Walmart+ member incentives ("Save $20 on your first purchase")

Category-specific codes like toys or holiday décor

Stacking opportunities during Black Friday While major doorbusters don't typically accept additional codes, our analysis shows nearly half of Walmart's codes are storewide—meaning they might apply even during sale periods for certain items.

Real-world promo code examples from our data

Storewide winners (42% of codes):

"20% Off Storewide at Walmart"

"$10 Off Storewide"

"Free shipping on any order"

Category-specific deals (40% of codes):

"$150 Off Level Smart Lock at Walmart"

"$15 Off Select Items (Min $100) – Members Only"

"Extra 10% off clearance patio furniture"

Specialty offers (18% of codes):

"$10 Off Grocery (Min $50) – Members Only"

"$15 Off first 4 online grocery orders"

"New Walmart+ members get 3-hour early Cyber Monday access"

Strategic insights for maximum savings

Best times to hunt for Walmart promo codes:

Late August/September: Peak clearance code activity

January/February: Post-holiday clearance boosts

Year-round: Monitor for floating storewide codes

Black Friday code strategy:

Don't expect major public coupon drops during peak sale periods

Check for active codes that might stack with sale prices

Walmart+ members receive exclusive promotional offers throughout the year

The bigger picture: Walmart's methodical approach extends beyond Black Friday. Our five-year analysis confirms they deploy every promotional tool—price cuts, promo codes, membership perks—with surgical precision to maximize value year-round.

Your Black Friday battle plan: 5 years of data in action

After analyzing 47,000 Walmart Black Friday deals across five transformative years, the path to maximum savings is clear. Walmart has evolved from a traditional one-day sale into a sophisticated, data-driven promotional machine that rewards strategic shoppers.

Mark these critical dates for Walmart Black Friday 2025

Wave 1: November 10-16

Online: Monday, Nov 10 (12 p.m. ET Walmart+, 5 p.m. ET everyone)

In-store: Friday, Nov 14 (6 a.m. local)

Strategy: Focus on toys, general electronics, home goods

Wave 2: November 24-30

Online: Monday, Nov 24 (same timing structure)

Black Friday: Friday, Nov 28 (6 a.m. local)

Strategy: Biggest doorbusters, premium TV deals, limited quantities

Cyber Monday: December 1

Early access: Sunday, Nov 30 (5 p.m. ET Walmart+)

Strategy: Final electronics deals, potential laptop/tech bargains

Your optimal shopping strategy

Walmart+ membership decision: At $98 annually, the 5-hour early access advantage has proven crucial for high-demand items. One secured doorbuster TV or gaming console justifies the entire membership cost.

Category timing intelligence:

Electronics: Shop Wave 2 for lowest TV prices, but grab popular items in Wave 1

Toys: Wave 1 offers best selection before holiday rush depletes inventory

Home goods: Available throughout both waves with consistent 50-60% discounts

Clothing: Less time-sensitive, often restocked between waves

Online vs. in-store approach: Prioritize online for doorbusters (they launch there first), then visit stores for peripheral shopping and potential unadvertised clearance discoveries.

Deal expectations based on five-year trends

Average discount projections: 40-45% across all categories, with doorbusters reaching 50-70% off

Must-watch categories for 2025:

75-inch TVs: Projected $499 doorbusters

Gaming bundles: Console + game packages with 20-30% effective savings

Smart home devices: 50% off Google/Alexa products as Matter standards expand

Popular toys: Whatever becomes 2025's must-have will anchor Wave 1 deals

The competitive advantage

Our analysis confirms Walmart's discount percentages consistently exceed Amazon (32% average) and Target (28.7% average). The dual-wave system, perfected over five years, maximizes both selection and savings compared to competitors' scattered promotional calendars.

Your action items:

Set calendar alerts for November 10 and 24 online launch times

Consider Walmart+ membership for early access advantages

Monitor SimplyCodes for any stackable promo codes during sale periods

Prepare wish lists in advance using Walmart's online deal tracking tools

Shop Wave 1 for toys and general needs, Wave 2 for doorbusters

The evolution from 2020's pandemic pivot to 2024's precision-engineered dual waves positions Walmart Black Friday 2025 as potentially their strongest yet. Armed with five years of data insights, you're ready to navigate America's largest retailer's biggest sale with confidence.

Looking for current Walmart deals? Find verified Walmart promo codes here

by Sean Fisher

AI Content Strategist · Demand.io

Sean Fisher is an AI Content Strategist at Demand.io, where he leads content initiatives and develops an overarching AI content strategy. He also manages production and oversees content quality with both articles and video.

Prior to joining Demand.io in September 2024, Sean served as a Junior Editor at GOBankingRates, where he pioneered the company's AI content program. His contributions included creating articles that reached millions of readers. Before that, he was a Copy Editor/Proofreader at WebMD, where he edited digital advertisements and medical articles. His work at WebMD provided him with a foundation in a detail-oriented, regulated field.

Sean holds a Bachelor's degree in Film and Media Studies with a minor in English from the University of California, Santa Barbara, and an Associate's degree in English from Orange Coast College.