Shoppers stand strong in the face of inflation, especially as over 50% of Gen Z adults report plans to spend more this year than before. High inflation coupled with recession concerns may test consumer budgets — however, coming out of several pandemic-disrupted seasons and a recently strengthened labor market, holiday shopping trends show that enthusiasm remains high for spending traditions.

Gen Z vs. Millennials vs. Gen X vs. Boomers: Key takeaways

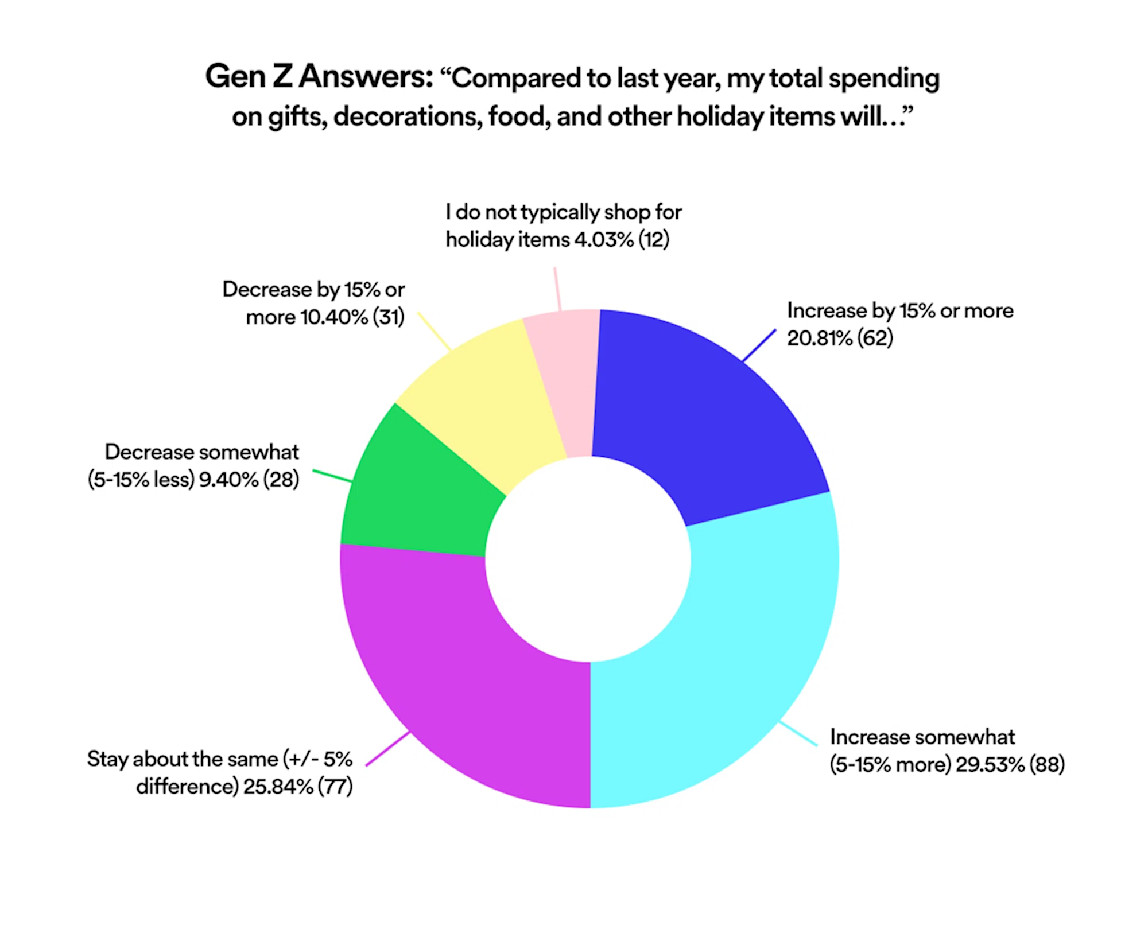

Gen Z adults stand out with the biggest projected spending gains, as over half expect to spend more compared to 2022. Their holiday outlook defies frugal stereotypes.

Over 36% of all respondents indicate plans to spend more this holiday season, suggesting consumer enthusiasm remains resilient despite inflation concerns.

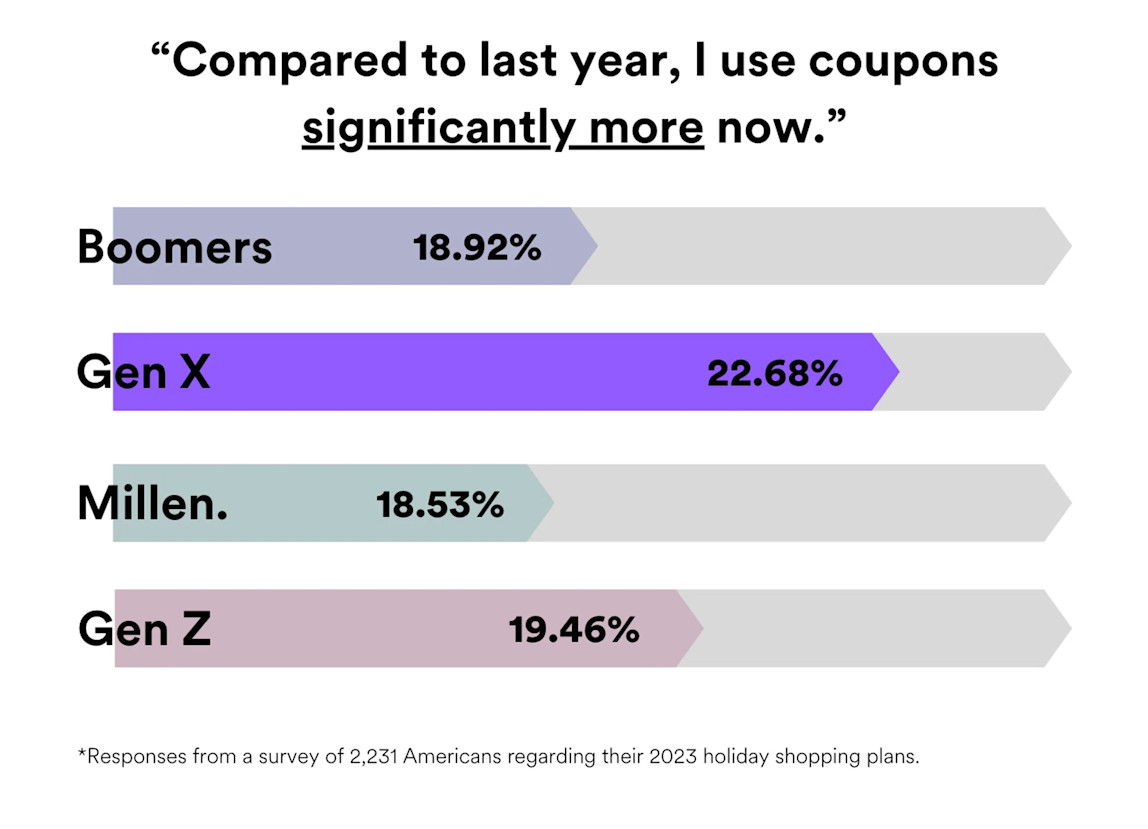

Online coupons will play a heightened strategic role across generations, with almost 50% of each group reporting increased usage, especially Gen X.

Lowest price remains the deciding purchase factor for a majority of shoppers, though Gen Z uniquely prioritizes shipping speed second.

How we surveyed shoppers

To understand the motivations, values, and behaviors influencing consumers this season, we conducted a survey of 2,231 Americans across four generational cohorts: Gen Z adults, Millennials, Gen X, and Baby Boomers. Our analysis reveals generational divides in budget expectations, willingness to pay full price, preferred shopping channels, and deal-hunting habits.

In this report, we share data-driven insights to show consumers how they stack up to other cohorts and to their peers, in terms of their spending attitudes this year. These insights also help retailers and marketers tailor engagement strategies for different demographic segments. By quantifying how generations plan to research, evaluate purchases, and spend this season, brands can craft relevant messaging and customer experiences.

We supplement our survey findings with third-party research and expert perspectives to provide full context. Our goal is to arm businesses with a nuanced understanding of 2023 priorities so they can connect meaningfully with diverse holiday shoppers. While key generational differences emerge, some themes unite all cohorts.

Spending Divide: Gen Z Splurges While Gen X Tighten Belts

Over 36% of Americans plan to spend more this holiday season. Although our findings also indicate an anxiety around rising prices, many Americans aren’t planning on cutting back on lifestyle purchases to address it.

Due to a combination of a strengthened labor market and an all-time-high inflation rate since 1981, over a third of Americans plan to spend more this winter. Meanwhile, 22.37% of Americans report cutting back spending, with the rest reporting no changes. Standout behaviors include:

Gen X trends more frugally over time. Far more than any other group, 13.69% of Generation X reports that they’re planning to cut back spending by over 15%.

Baby Boomers will have the least fluctuation in spending habits this year. About 44% of Baby Boomers report no planned changes in spending.

Key Finding: A majority of Gen Z is spending more than ever. Over half of Gen Zers will shell out more cash this holiday season.

Attitudes Towards Inflation, Employment, and Student Debt

From inflation pressures to urgency over student loans, we examined the top factors influencing spending decisions this year. Undoubtedly, price inflation remains at the top of people’s minds. Even when folks report no plans to cut back spending, there’s a simmering undercurrent of price anxiety.

In second place, “Changes in income/employment” posed an ambiguous response, as it encapsulates both prosperity in employment and promotions, or anxiety in layoffs and downturns.

This year also heralds the resumption of student loan payments after a 3-year pause.

Back in June, the Supreme Court also struck down the Biden administration’s student loan forgiveness program. Although the administration has proposed alternative debt relief plans, the interest-free payment delays from the Covid-19 pandemic have effectively ended this past month, which may impede spending optimism after this holiday season. But for now, financial enablement and relief-supported momentum have bolstered Gen Z spending confidence.

Spending Psychology: When, Where, and How Much?

When are holiday shoppers spending?

Gen Z plans to shop the closest to December.

Almost a quarter of Baby Boomers plan to complete most of their shopping before November. 33.03% of Gen X aim to shop in early November. A 30.41% majority of Millennials plan to shop at the end of November.

Where are holiday shoppers spending?

Seasoned Screenagers: Over 79% of Baby Boomers and Gen Xers have taken their shopping online.

How much are Americans spending this year?

Key Finding: Gen Z are far more likely than Baby Boomers to pay full price. Boomers are unlikely to check out without a deal.

When it comes to deal-seeking, Gen Z is much more accepting of full price. According to our survey, over 54% of Gen Z respondents said they buy at full price compared to around 38% of Baby Boomers.

Additionally, while nearly 26% of Boomers said they always look for the lowest price, less than 15% of Gen Z said the same. This indicates that Gen Z shoppers are far more willing to pay retail prices during the holidays than older generations like Baby Boomers. One potential factor is Gen Z's focus on buying exactly what they want regardless of deals available. Meanwhile, Boomers hunting for discounts reflect more budget-conscious motivations.

In this day and age, coupons may be rarer in offerings and difficult to discover, especially in the digital age. With the rise of brands like Apple that seemingly never offer discounts, along with the overall difficulty of discovering online promo codes, perhaps young digital natives have embraced paying full price if they didn’t grow up clipping coupons.

Pain Points: Where Americans Are Hurting This Year

Couponing more than ever? Gen X and Gen Z

A hefty 22.68% of Gen X says they will rely on online coupons significantly more this year than last year.

Over 51% of Gen Z reports using online coupons more in general than last year. In tandem with the previous finding, it appears that although Gen Z has taken to coupons more than last year, their tolerance for full price remains high. Compared to couponing veterans like Baby Boomers, Gen Z is just discovering the coupon lifestyle. This finding also makes sense because if Gen Z are shopping far more overall, then their general couponing naturally increases as well.

Is Debt Accrual the New Trend?

Financial Caution: Culture Shift

Around 30% of respondents reported an effort to be more budget-conscious overall, regardless of financial situation. This is intriguing, because of the respondents that claimed financial caution, over 66% also reported that their holiday spending would either stay the same or increase — indicating a desire to spend less, but an expectation of higher prices.

After Effects: Student Loans & Debt

After an approximate 3 three-year pause, student loan payments resumed on October 1, 2023. The Supreme Court also struck down President Biden’s plan to forgive student debt for qualified borrowers. This combination has placed stress back on younger shoppers this holiday season.

56.04% of Gen Z respondents report the impact of student loans & debt as a primary factor in spending decisions this year — however, the combined factors of improved income and acknowledgement of high prices could explain the fact that over half of Gen Z report spending more this year. There’s top-of-mind financial stress among these respondents, but Gen Z remains a strong spending demographic this year.

23.34% of Millennials and 20.81% of Gen X also report the impact of student loans & debt as a major factor in spending decisions.

Unique Behaviors by Age Group

Fast Takes: Holiday Shopping Preferences

Gen Z values fast shipping over brand reputation.

55% of Gen Z ranked shipping speed as more important than brand when holiday shopping.

Gen X is most likely to buy gift cards as presents.

72% of Gen X plan to buy gift cards this holiday season.

Over 21% of Millennials plan to shop for handmade/artisan gifts.

Millennials are most likely to purchase experiences over products.

Nearly 26% of Baby Boomers report always seeking a discount when shopping

We asked: What else are you gifting this year?

Popular responses: Books & Handmade Gifts

Consistent picks: Desserts & Cash

Surprising responses: Flight Credit & Subscriptions

Recommendations for Shoppers and Businesses

Audience Insights

Gen Z may be most susceptible to “Last Minute Gifts” marketing due to their reported shopping timeline. Any marketing to older audiences should be launched closer to October.

Gen X and Baby Boomers are leaning heavily into eCommerce — over 79% of both demographics plan to cybershop.

Baby Boomers are least likely to checkout without a sale, promotion, or coupon.

Recommendations for Shoppers

For Gen Z shoppers: In last-minute, priority-speed delivery crowd? Many retailers have expanded their fulfillment operations to compete with Amazon’s Prime Shipping — we’d suggest comparing retailers to brand websites, and possibly opt for in-store or curbside pickup this year to tackle any shipping issues ahead of time.

For Millennial shoppers: This tip is more for those gifting for a Millennial recipient. Since this age group trends more towards artisanal and experiential gifts, explore craft markets or find event tickets for your Millennial-aged loved ones.

For Gen X shoppers: The data says this group lean heavily towards gift cards, but there’s still a way to spice up this versatile gift: try gifting experiential gift cards like ones from Airbnb and ClassPass.

For Baby Boomer shoppers: The data says this generation is moving online, but still cares about savings. Try out a comprehensive coupon browser extension to simplify finding good deals on gifts online.

Recommendations for Retailers

Optimize sitewide sales and promotions during October and November when Gen X and Boomers are doing the bulk of their online shopping. Highlight discounts across categories.

On digital channels, feature gift ideas and discounts for late shoppers when targeting Gen Z in late November and December.

Recommendations for Brands

Launch holiday promotions and gift bundles by October to align with early Boomer and Gen X digital purchasing timeframes.

Partner with social influencers relevant to Gen Z audiences for late-season push targeting last-minute shoppers.

Prioritize value messaging in holiday campaigns. Communicate savings off retail prices as Boomers remain discount-driven.

Test catalogs, digital ads, and direct mail directed at Gen X and Boomers shopping more online.

Methodology & Considerations

This report is based on findings from an online survey conducted in September 2023 with 2,231 total respondents across the United States from generational cohorts Gen Z, Millennial, Gen X, and Baby Boomer.

Baby Boomers were defined to respondents as those born between 1946-1964; Gen X as 1965-1980; Millennial as 1981-1996; Gen Z at 1997-2012. Only adults were screened, so the Gen Z cohort is limited to respondents over eighteen.

The survey included 481 Baby Boomer respondents, 745 Generation X respondents, 707 Millennial respondents, and 298 Adult Gen Z respondents. The age group sample sizes were designed to provide statistically significant representation from each cohort.

The survey was fielded using a SurveyMonkey Audience general population panel and included a mix of multiple-choice, open-ended, and ranking questions on holiday shopping behaviors, budgets, preferences, and values.

The sample aimed for representative distribution across gender, region, income levels, and device types within each generation. Potential skews include a higher number of female respondents at 58% vs. 42% male, which may have impacted results. Questions of whether the individual shopped on behalf of their household were not included. Data was analyzed using demographic segmentation to uncover differences by generation.

Generational self-identification was verified through a birth year question. All verbatim examples are provided anonymously and with permission. Names and contact details were not collected.

Interested in more data stories and shopping analyses? Follow us on X to stay informed on our research stories.

by SimplyCodes

Author · SimplyCodes

SimplyCodes combines e-commerce expertise, data science, and insights from our 100,000+ community members to help shoppers find the best deals online. With access to real-time data on over 400,000 stores and powered by advanced AI technology, we work to make online shopping more affordable and accessible for everyone. We bring together technical innovation and community wisdom to deliver accurate, up-to-date savings opportunities across the internet.