Mark your calendar: April 4-15 and November 1-11 Beauty Insider sales offer the most predictable savings (10%-20% off based on membership tier)

Target category sales for maximum savings: Shop skincare in January, hair in May/October, fragrances in December

Membership matters more than ever: approximately 56% of promotions are member-exclusive, with Rouge members receiving best discounts

Free gifts dominate Sephora's strategy: approximately 25.6% of all promotions involve free offers, usually with minimum purchases

Sephora's promotional volume has stabilized at 135-182 annual codes since 2022, following an intentional 70% reduction

While the beauty industry increases promotions (11,394 industry-wide codes in 2024), Sephora maintains a selective approach

2025 continues the pattern: The 36 codes released through March 2025 align with post-2022 trends, projecting 135-150 total promo codes released by Sephora this year

Smart beauty shoppers know that timing is everything when it comes to saving at Sephora. SimplyCodes' analysis of Sephora's promotional patterns reveals clear opportunities for strategic shopping in 2025. Let's examine the SimplyCodes intelligent shopping data to identify when you'll find the best deals this year.

How many promo codes does Sephora release?

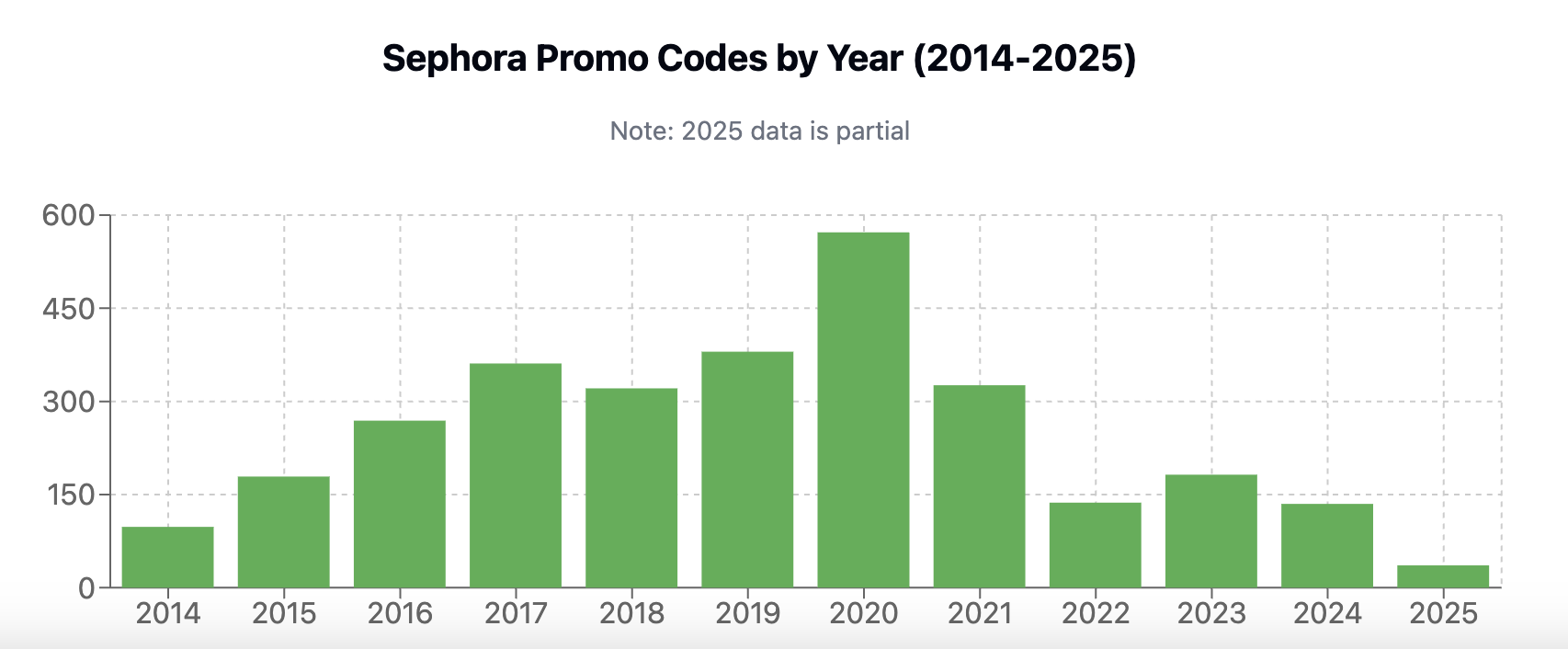

SimplyCodes proprietary data reveals exactly how Sephora's promotional strategy has evolved over time:

Sephora promo codes by year (2014-2025)

Year | Number of promo codes | Notes |

2014 | 98 | Initial baseline |

2015 | 179 | Growth period begins |

2016 | 269 | Continued expansion |

2017 | 361 | Strong growth year |

2018 | 321 | Slight adjustment |

2019 | 380 | Pre-pandemic peak |

2020 | 572 | All-time peak (pandemic) |

2021 | 326 | Post-peak adjustment |

2022 | 137 | Strategic reduction |

2023 | 182 | Slight recovery |

2024 | 135 | Stabilization |

2025 (so far) | 36 | Partial year data |

What this means for shoppers in 2025

This data tells an important story about how Sephora has transformed its promotional approach, with clear implications for how you should shop in 2025:

The era of constant promotions is over: After reaching a pandemic-fueled peak of 572 codes in 2020, Sephora has deliberately reduced promotional volume by 70%, stabilizing around 135-182 annual codes since 2022. For shoppers, this means fewer overall opportunities but more strategic, valuable promotions.

Structured sales have replaced random deals: Rather than releasing frequent, unpredictable codes, Sephora now focuses on structured sales events with consistent timing and discounts. This makes shopping more predictable—you can confidently plan major purchases around reliable events like the Beauty Inside sales in April and November.

Selective shopping is essential: With fewer overall promotions, timing your purchases around key sales events becomes crucial. The days of expecting to find a promotion anytime you shop are over—strategic patience now yields the best savings.

2025 continues the pattern: The 36 codes released so far in 2025 (through March) align perfectly with the post-2022 pattern, suggesting Sephora will maintain this selective approach throughout the year with approximately 135-150 total codes projected.

Beauty Insider membership matters more than ever: With fewer promotions overall, the guaranteed discounts from Beauty Insider sales (10%-20% based on tier) have become proportionally more valuable.

This transformative shift means beauty enthusiasts need to be more strategic than ever, focusing on Sephora's most reliable sales events rather than expecting constant discounting.

Sephora's promotional evolution: What the data shows

SimplyCodes has tracked and analyzed thousands of Sephora promo codes from 2014 through March 2025, revealing three distinct phases in the beauty retailer's promotional strategy:

Phase | Years | Annual codes | Key characteristics |

Growth period | 2014-2019 | 98-380 | Steady expansion of promotional activity |

Pandemic peak | 2020-2021 | 326-572 | Exceptional volume during retail disruption |

Strategic recalibration | 2022-2025 | 135-182 | Selective, structured approach |

While most beauty retailers have increased promotional activity (the industry grew from 2,819 codes in 2017 to 11,394 in 2024), Sephora has intentionally reduced and stabilized its promotional volume since 2022, signaling a focus on quality over quantity.

2025 Sephora month-by-month analysis

Let's examine each month in detail based on historical data from 2014-2025, with special attention to recent patterns from 2022-2025:

January: Targeted skincare focus

Courtesy of Sephora

Courtesy of SephoraRecent pattern (2022-2025): 8-21 promo codes annually

2025 activity: 8 promo codes released

January data shows consistent but moderate promotional activity in recent years. The Skincare Sale (Jan 2-17) offering 50% off different brands daily has become a reliable fixture, directly competing with Ulta's Love Your Skin Event.

Looking at 2025's 8 promotional codes, we see a return to pre-pandemic levels similar to 2017-2019 (7-11 codes), rather than the elevated activity of 2021 (30 codes).

February: Lowest promotional month

Recent pattern (2022-2025): 7-12 promo codes annually

2025 activity: 7 promo codes released

February consistently shows the lowest promotional volume across all years in our dataset. The 7 promotional codes issued in February 2025 align perfectly with this historical pattern.

Recent activity focuses primarily on Valentine's Day and occasional Presidents' Day promotions, typically offering bonus points rather than percentage discounts. This month has maintained remarkably consistent low promotional volume even through pandemic fluctuations.

March: Spring sale kickoff

Courtesy of Reddit

Courtesy of RedditRecent pattern (2022-2025): 7-28 promo codes annually

2025 activity: 7 promo codes released

March shows more variable promotional activity, with 2023 being a notable outlier (28 codes). However, the 7 promotional codes released in March 2025 align closely with 2022 and 2024 levels (8 and 11 codes respectively), suggesting consistency in Sephora's current approach.

The 50% Off One-Day Deals (Mar 7-27) has become March's promotional anchor, offering significant daily discounts that mirror Ulta's 21 Days of Beauty event.

April: Beauty Insider sale month

Courtesy of Sephora

Courtesy of Sephora Recent pattern (2022-2025): 13-16 promo codes annually

Expected 2025 activity: 14-16 promo codes

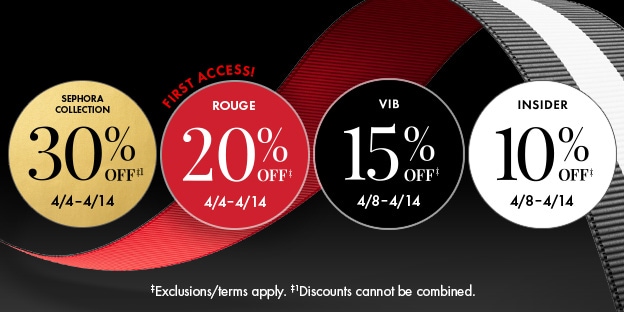

April consistently shows higher promotional volume in recent years, primarily centered around the Spring Beauty Insider Sale. This event maintains remarkably consistent timing and discount structure:

Rouge members: 20% off (early access period)

VIB members: 15% off

Beauty Insiders: 10% off

Sephora Collection: 30% off for all tiers

This event has become one of the most reliable savings opportunities in Sephora's annual calendar, maintaining consistent promotional volume even as Sephora reduced activity in other months.

May: Transitional promotional period

Courtesy of Reddit

Courtesy of RedditRecent pattern (2022-2025): 9-28 promo codes annually

May shows more variable promotional activity, with 2022 representing a significant outlier (28 codes). Recent years (2023-2024) have shown more moderate activity (9-21 codes), suggesting a normalized approach.

Key May events include the Oh Hair Yeah! Spring Sale (typically Apr 30-May 11) and Memorial Day promotions, which create moderate savings opportunities as summer approaches.

June: Selective summer promotions

Recent pattern (2022-2025): 8-10 promo codes annually

June data reveals an interesting story about Sephora's promotional evolution. While June saw extraordinary activity during the pandemic (54 codes in 2021), recent years show a consistent but moderate approach (8-10 codes annually).

This represents a significant recalibration from pandemic-era strategies. June no longer stands out as Sephora's most promotional month in 2022-2024 data, suggesting a shift away from the summer-heavy approach of earlier years.

July: Focused summer events

Courtesy of Sephora

Courtesy of Sephora Recent pattern (2022-2025): 8-17 promo codes annually

Similar to June, July shows a significant reduction from its pandemic peak (68 codes in 2020) to a more moderate but consistent 8-17 codes annually in recent years. While 2023 saw a slight uptick (17 codes), the overall pattern indicates a strategic, selective approach rather than the volume-heavy tactics of 2020-2021.

Key July events include Summer Deal Week (typically Jul 4-10) and National Lipstick Day (Jul 29), providing targeted savings opportunities.

August: Post-summer adjustment

Recent pattern (2022-2025): 8-12 promo codes annually

August data shows consistent moderate activity in recent years, with 8-12 codes annually since 2022. This represents a significant reduction from pandemic-era levels (38-40 codes in 2020-2021).

The 8 Days of App-Only Offers has emerged as August's primary promotional event, focusing on mobile engagement rather than broad discounting.

September: Exclusive sale opportunity

Courtesy of Sephora

Courtesy of Sephora Recent pattern (2022-2025): 3-17 promo codes annually

September shows more variable activity, with 2023 representing the high end (17 codes) and 2024 the low end (3 codes) of recent patterns. The Friends & Family Sale offers an exclusive 20% savings opportunity, though it requires access codes typically distributed through Sephora employees.

October: Pre-holiday positioning

Recent pattern (2022-2024): 4-19 promo codes annually

October shows considerable variation in recent years, with 2023 (19 codes) significantly outpacing 2022 (4 codes). This variability may reflect Sephora's testing of different pre-holiday strategies.

The Oh Hair Yeah! Fall Sale and National Brow Day (Oct 2) provide category-specific savings opportunities as the holiday season approaches.

November: Holiday Savings Event

Courtesy of Sephora

Courtesy of Sephora Recent pattern (2022-2024): 6-8 promo codes annually

Despite being home to Sephora's major Holiday Savings Event, November shows remarkably consistent but moderate promotional volume in recent years (6-8 codes annually). This suggests a concentrated approach focused on the Beauty Insider sale rather than numerous smaller promotions.

The Holiday Savings Event maintains the same tier-based structure as the spring sale:

Rouge members: 20% off (early access period)

VIB members: 15% off

Beauty Insiders: 10% off

December: Holiday and year-end promotions

Courtesy of Reddit

Courtesy of RedditRecent pattern (2022-2024): 10-14 promo codes annually

December maintains slightly higher promotional volume than most months in recent years (10-14 codes annually), focusing on holiday gift sets and year-end promotions.

Key December events include the Gifts for All Event (offering 20% off for all Beauty Insiders), the Fragrance for All Event (Dec 13-24), and the After-Christmas Sale (Dec 26-Jan 1).

2025 promotional predictions by quarter

Based on 2022-2024 patterns and Q1 2025 data, here's what we can expect for the rest of 2025:

Q2 2025 (April-June)

April: 14-16 codes, centered around the Spring Beauty Insider Sale

May: 9-15 codes, including Oh Hair Yeah! Spring Sale and Memorial Day promotions

June: 8-10 codes, focusing on summer beauty essentials

Q3 2025 (July-September)

July: 10-15 codes, including Summer Deal Week and National Lipstick Day

August: 8-10 codes, featuring App-Only Offers

September: 5-12 codes, including the exclusive Friends & Family Sale

Q4 2025 (October-December)

October: 10-15 codes, including Oh Hair Yeah! Fall Sale

November: 6-8 codes, centered around the Holiday Savings Event

December: 10-14 codes, featuring gift sets and after-Christmas clearance

2025 Sephora sales calendar

While Sephora's overall promotional strategy has evolved, certain sales events have maintained remarkable consistency. These represent the most reliable savings opportunities for 2025:

Event | Expected timing | Member discount | Reliability |

Spring Beauty Insider Sale | April 4-15 | Rouge: 20%, VIB: 15%, Insider: 10% | Very High |

Oh Hair Yeah! Spring Sale | Apr 30-May 11 | Up to 50% off hair products | High |

Summer Deal Week | July 4-10 | Various brand-specific offers | Medium |

National Lipstick Day | July 29 | Up to 50% off lip products | High |

Friends & Family Sale | Early September | 20% with special access code | Medium |

Oh Hair Yeah! Fall Sale | Early October | Up to 50% off hair products | High |

Holiday Savings Event | November 1-11 | Rouge: 20%, VIB: 15%, Insider: 10% | Very High |

Gifts for All Event | Early December | 20% off for all Beauty Insiders | High |

Membership benefits dominate Sephora's 2024-2025 promotion strategy

Analysis of Sephora's promotional patterns during the past 12 months (2024-2025) reveals a strategic focus on membership-driven offers and purchase thresholds. Out of Sephora's most frequently offered promotions in this period:

56% require Beauty Insider membership to access

72% include minimum purchase requirements ($30-$100)

Free gifts dominate over percentage or dollar-off discounts

This recent data shows Sephora's calculated approach to promotions, using membership status and spending thresholds to drive customer loyalty and increase average order value during 2024-2025.

Most frequent Sephora promotions (past 12 months)

Promotion type | Frequency | Requirements |

Free Gift with Purchase | 37 instances | Members only, $30+ minimum |

Storewide Dollar Discounts | 8 instances | Members only, $50-$100 minimum |

Free Gift for All Shoppers | 7 instances | No membership, various minimums |

Select Item Discounts | 5 instances | Mixed requirements |

The pattern in Sephora's recent 2024-2025 promotional strategy is clear: the company creates a tiered value system where membership and spending thresholds unlock progressively better offers. This approach:

Incentivizes program enrollment - Even basic Beauty Insider membership (free) unlocks numerous exclusive offers

Encourages higher spending - Multiple minimum purchase thresholds push basket sizes up

Builds loyalty through exclusivity - Making most promotions member-exclusive reinforces program value

Membership value by tier

The membership advantage increases dramatically at higher tiers:

Beauty Insider (free): Access to member-exclusive promotions and 10% off during seasonal sales

VIB ($350/year): All Beauty Insider benefits plus 15% off during seasonal sales

Rouge ($1000/year): All lower-tier benefits plus 20% off during seasonal sales and exclusive early access

For a shopper spending $1,000 annually at Sephora, Rouge status essentially provides a guaranteed $100 in savings during spring and fall sales alone, plus exclusive access to limited-quantity offerings and member-only promotions.

This structured approach makes membership increasingly valuable as customers climb tiers, creating a clear incentive for loyalty and increased annual spending.

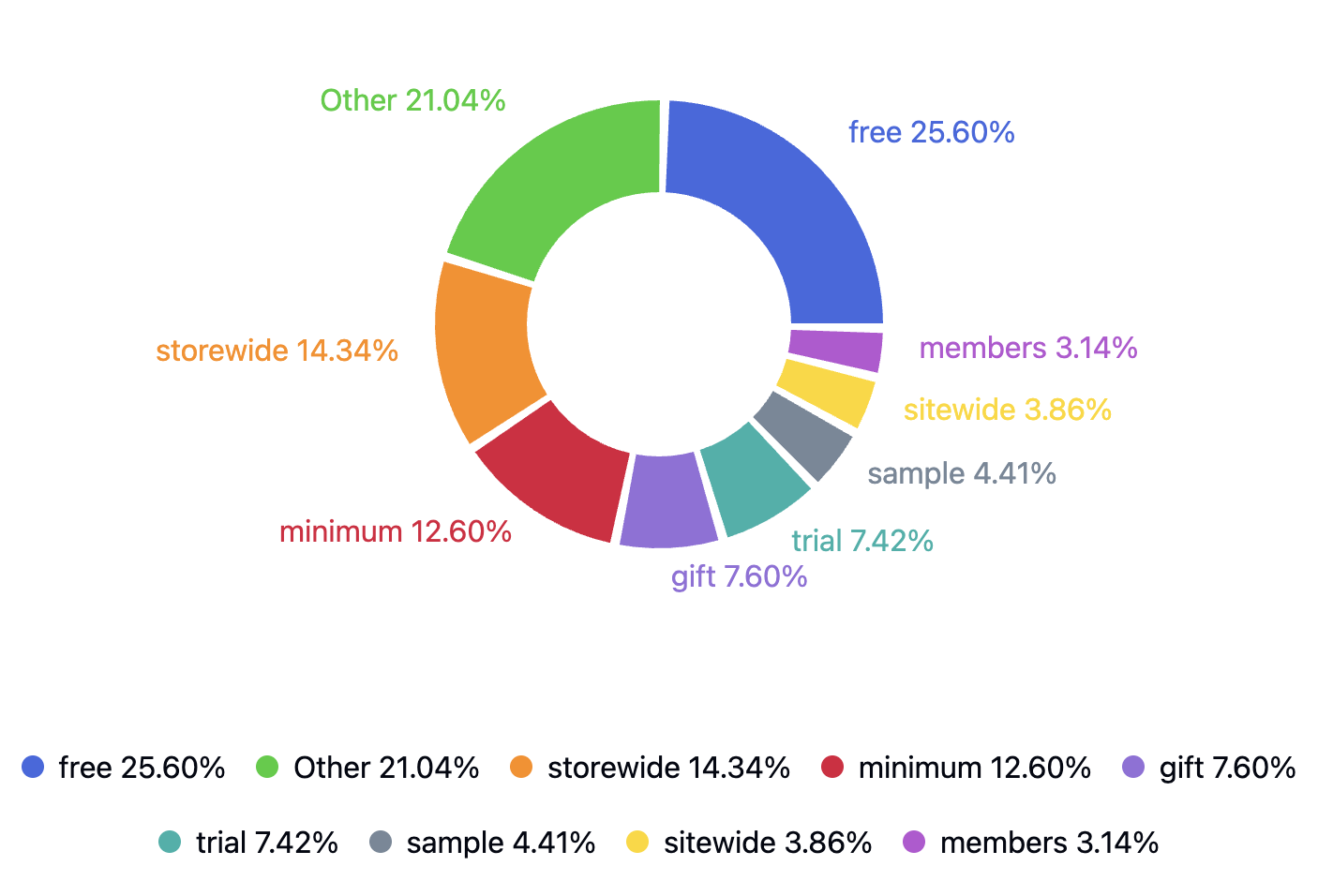

Sephora’s promotion strategy for all-time

While Sephora's current promotional approach has evolved considerably, examining their all-time promotional patterns reveals valuable insights into the brand's long-term strategy. Analysis of all historical Sephora promo codes shows several key terms that have dominated their approach:

Free offers lead Sephora's historical strategy with 25.6% of all promotional language. This preference for "free" incentives (typically free gifts with purchase) has been a cornerstone of Sephora's approach, creating perceived value while encouraging spending.

Storewide promotions represent 14.3% of Sephora's promotional language, indicating the brand's strategic emphasis on broad-based discounts that apply across product categories.

Minimum purchase requirements appear in 12.6% of promotional language, revealing Sephora's consistent strategy of driving higher transaction values through spending thresholds that unlock benefits.

Gift offers (7.6%) and trial promotions (7.4%) continue to be significant elements of Sephora's approach, demonstrating the beauty retailer's focus on introducing customers to new products through sampling opportunities.

Sample offers (4.4%), sitewide promotions (3.9%), and member-exclusive deals (3.1%) round out Sephora's promotional vocabulary, showing the brand's layered approach to customer incentives.

Other promotional terms account for 21% of Sephora's promotional language, highlighting the diversity of their marketing approach beyond these core strategies.

This long-term view confirms that while Sephora's promotional volume has decreased significantly, their fundamental approach of using free offers, storewide discounts, and minimum purchase requirements has remained consistent throughout their promotional history.

Sephora's promotional strategy vs. industry trends

Sephora's selective approach stands in stark contrast to broader beauty industry trends:

Year | Sephora promo codes | Beauty industry total codes | Sephora's Approach |

2017 | 361 | 2,819 | Growth phase |

2020 | 572 | 9,778 | Peak promotion year |

2024 | 135 | 11,394 | Strategic restraint |

2025 (proj.) | 135-150 | 12,000+ (est.) | Continued selectivity |

While the overall beauty industry has dramatically increased promotional activity, Sephora has intentionally reduced and stabilized its promotional volume. This indicates a strategic focus on structured sales events rather than constant discounting.

Read here to find out who leads coupon releases in the beauty industry

Maximizing your Sephora savings in 2025

Based on our data analysis, here are the most effective strategies for maximizing your Sephora savings in 2025:

Focus on the Beauty Insider sales

The April and November Beauty Insider sales represent the most predictable, valuable savings opportunities of the year:

Mark your calendar for April 5-15 and November 1-11 (projected dates)

Plan major purchases around these events for guaranteed 10-20% savings

Consider tier status for early access and higher discount percentages

Target category-specific opportunities

Plan category purchases around specialized sales for maximum savings:

Skincare: January Skincare Sale (50% off featured brands daily)

Hair care: May and October Oh Hair Yeah! Sales (up to 50% off)

Fragrances: December Fragrance for All Event (20% off)

Holiday sets: December After-Christmas Sale (extra 20% off)

Optimize your membership tier

With member-exclusive promotions representing a significant portion of Sephora's strategy, membership tier matters more than ever:

Calculate whether spending to reach VIB or Rouge status makes financial sense based on your annual Sephora budget

Consider the value of early access during major sales events

Take advantage of Rouge friend sharing benefits during Beauty Insider sales

Watch for single-day events

Don't overlook one-day events offering significant category-specific savings:

National Lipstick Day (July 29): Up to 50% off lip products

National Brow Day (October 2): Savings on eyebrow products

Know when to shop at Sephora

Our data analysis reveals that Sephora has shifted from high-volume promotions to a more selective, structured approach since 2022. While pandemic-era patterns (particularly the summer promotional peaks) have faded, clear patterns have emerged in the retailer's current strategy.

For beauty enthusiasts planning 2025 purchases, our recent data suggests:

Focus on the predictable Beauty Insider sales in April and November

Watch for category-specific sales aligned with your beauty needs

Consider membership tier benefits when planning major purchases

Be strategic about timing for the most reliable savings opportunities

By understanding Sephora's current promotional patterns rather than relying on pandemic-era trends, shoppers can maximize their savings despite the retailer's more selective approach to promotions in 2025.

How we get this data: Promo code data is sourced from SimplyCodes shopping data, our proprietary knowledge system that continuously monitors 400,000+ stores. Every code is verified through our dual AI and community testing process.

Looking for the latest Sephora promotions? Find verified Sephora promo codes here

by Sean Fisher

AI Content Strategist · Demand.io

Sean Fisher is an AI Content Strategist at Demand.io, where he leads content initiatives and develops an overarching AI content strategy. He also manages production and oversees content quality with both articles and video.

Prior to joining Demand.io in September 2024, Sean served as a Junior Editor at GOBankingRates, where he pioneered the company's AI content program. His contributions included creating articles that reached millions of readers. Before that, he was a Copy Editor/Proofreader at WebMD, where he edited digital advertisements and medical articles. His work at WebMD provided him with a foundation in a detail-oriented, regulated field.

Sean holds a Bachelor's degree in Film and Media Studies with a minor in English from the University of California, Santa Barbara, and an Associate's degree in English from Orange Coast College.