Beauty/skincare industry releases 337% more promo codes than in 2017, with 11,384 codes in 2024 alone (a 14.3% year-over-year increase)

Q1 2025 shows strong promotional activity with 2,500 codes, on pace to match or exceed 2024's elevated volume

ULTA leads all-time coupon releases with 1,225 promotional codes, more than double any competitor

iGoNatural tops recent rankings with 318 codes over the past two years

Storewide codes represent 51.5% of all beauty promotions, offering the broadest savings

November and December consistently offer the highest volume of beauty promo codes

As beauty spending continues to rise in 2025, understanding which brands offer the most frequent coupon opportunities has never been more important. SimplyCodes' analysis of beauty industry promotional patterns reveals clear leaders in both traditional and emerging beauty brand categories that will help you save. Let's examine the data to identify which skincare, makeup, cosmetic, and beauty brands consistently offer the best savings opportunities in 2025.

Top skincare brands for coupons

Our proprietary data reveals clear leaders in promotional activity across the beauty industry, with significant differences between historical leaders and today's most active brands:

Top 15 beauty brands by all-time promo codes

Our analysis of historical promotional data reveals a clear hierarchy dominated by major beauty retailers and established luxury brands:

Brand | All-time promo codes |

1,225 | |

Beautyhabit | 743 |

717 | |

604 | |

590 | |

572 | |

563 | |

547 | |

510 | |

507 | |

495 | |

FeelUnique UK | 492 |

Sephora CA | 479 |

477 | |

Adore Beauty | 458 |

Top 15 beauty brands by recent promo codes (last 2 years)

Interestingly, when we focus on recent promotional activity from the past two years, a mostly different set of brands emerge. These brands will be where shoppers can most likely get promo codes currently:

Brand | Promo codes released last 2 years |

318 | |

266 | |

262 | |

241 | |

215 | |

186 | |

ULTA | 182 |

CHOIZE | 170 |

164 | |

Julep | 158 |

148 | |

UK | 148 |

142 | |

133 | |

131 |

Most common cosmetic promo codes among top skincare brands

Our analysis of the most frequently used promotional offers reveals interesting patterns among leading skincare brands:

Count | Promo code title | Brand |

253 | 10% Off Storewide | Hello Joyous |

188 | 20% Off Storewide | iGoNatural |

165 | 10% Off Storewide | CHOIZE |

138 | 10% Off Storewide | Ma French Beauty |

112 | 10% Off Storewide | Aimanfun |

109 | 10% Off Storewide | |

107 | 10% Off Storewide | Bellah Roze |

106 | 10% Off Storewide | Give Me Cosmetics |

96 | 10% Off Storewide | BellaRose Beauty Collections |

95 | 10% Off Storewide | |

91 | 10% Off Storewide | |

91 | 10% Off Storewide | |

89 | 10% Off Storewide |

What this means for shoppers in 2025

The data reveals several significant insights for beauty shoppers looking for the top skincare brands with coupon opportunities:

Storewide discounts dominate skincare promotions: The most common promo code type across all top beauty brands is the storewide discount, with 10% and 20% off being the standard offer amounts. This means skincare shoppers should expect these baseline discount levels and look for higher percentages during special events.

Dramatic shift in promotional leaders: While ULTA dominates all-time rankings with 1,225 total codes, emerging brands like iGoNatural (318 codes) and Hello Joyous (266 codes) have become the top sources for coupons in recent years.

Digital-native brands offer most frequent discounts: The recent promo code data reveals that online-focused, direct-to-consumer brands now lead in promotional frequency, with 7 of the top 10 recent leaders being digital-native companies.

Only two brands appear in both rankings: Only ULTA and Julep appear in both the all-time and recent top 15 lists, indicating a significant transformation in the promotional landscape. Traditional leaders like Estee Lauder and Clinique have been supplanted by newer brands in terms of promotional frequency.

Beauty by Earth emerges as top skincare-specific brand: Among brands focused primarily on skincare (rather than general beauty), Beauty by Earth leads with 164 codes in the past two years, making it the top pure skincare brand for coupon-seeking shoppers.

International brands show strong presence: Brands with UK and European origins (ForeverLux, Boots, Notino UK) feature prominently in recent promotional activity, offering potential savings for shoppers willing to order internationally.

For shoppers seeking the most coupon opportunities in 2025, this data clearly suggests prioritizing digital-native brands like iGoNatural, Hello Joyous, and Beauty by Earth, while still watching established players like ULTA and Julep that maintain strong promotional calendars.

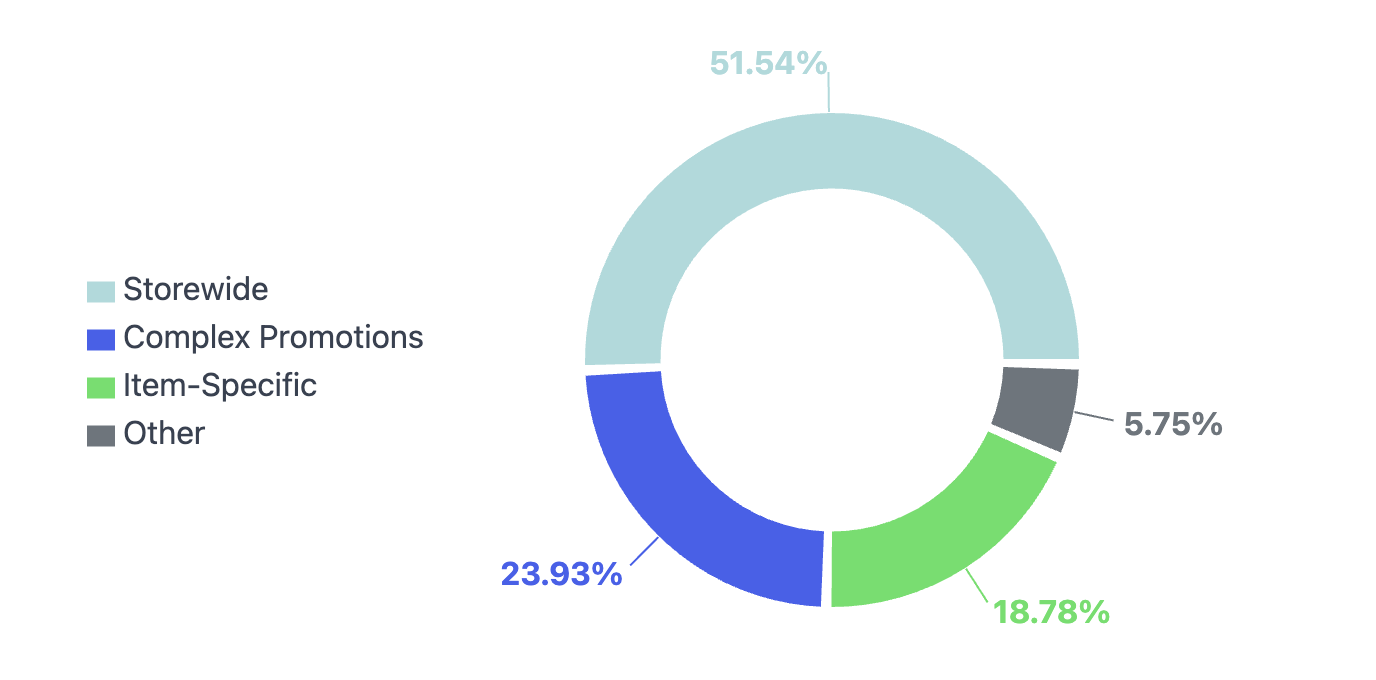

Beauty promo code types

SimplyCodes has tracked and analyzed thousands of beauty sales and promo codes, revealing important patterns in the types of promotions offered:

Promotion types across beauty brands

Promotion type | Percentage | Total codes |

Storewide | 51.50% | 35,149 |

None | 23.95% | 16,346 |

Items | 18.79% | 12,824 |

Other | 5.76% | 3,932 |

Total | 100% | 68,250 |

The data reveals that storewide promotions—those applicable to an entire product catalog—represent more than half (51.5%) of all beauty promotions. This offers shoppers the broadest opportunity for savings as these codes can typically be applied to any purchase.

Item-specific promotions (18.79%) target particular products or categories, often offering deeper discounts but with limited applicability. These are frequently used to promote new product launches or clear seasonal inventory.

Notably, nearly 24% of tracked promotions had no specific classification, typically representing more complex promotional structures (buy-one-get-one, tiered discounts, or gift-with-purchase offers).

Top 3 skincare brands for coupons in 2025

Based on our data analysis, three brands emerge as the clear leaders for promotional opportunities in 2025. Let's examine what makes these brands stand out and what shoppers can expect from each:

1. iGoNatural: The promotional powerhouse

iGoNatural leads all beauty brands with 318 promotional codes released in the past two years, making it the top destination for consistent savings opportunities. Our analysis reveals several key insights about their promotional strategy:

Storewide focus: An impressive 97.48% of iGoNatural's promotions are storewide codes, meaning almost all their discounts apply to their entire catalog

Higher discount values: Their most common promotion is "20% Off Storewide" (188 instances), offering deeper discounts than most competitors

Consistent secondary offerings: They also frequently offer 10% Off Storewide (83 instances) and $20 Off Storewide (19 instances)

Peak promotional timing: August is their most promotion-heavy month, with 55 code releases in August 2024 alone

Occasional premium discounts: They periodically offer 25%-30% off storewide promotions, though these are less frequent

For shoppers seeking natural beauty products with reliable discount opportunities, iGoNatural offers the most consistent promotional calendar with above-average discount percentages.

2. Hello Joyous: The storewide specialist

With 266 promotional codes over the past two years, Hello Joyous takes second place in our rankings. Their promotional strategy reveals an even stronger commitment to storewide discounts:

Near-exclusive storewide focus: An exceptional 98.87% of their codes are storewide discounts, the highest percentage among top brands

Consistent baseline offering: Their dominant promotion is "10% Off Storewide" (253 instances)

Limited variability: Unlike iGoNatural, Hello Joyous rarely varies from their standard 10% discount, with only occasional 15% or 20% offerings

Spring peak activity: April is their promotional sweet spot, with 145 codes released in April 2024

New customer incentives: They occasionally offer "10% Off In First Order" promotions to attract new customers

Hello Joyous offers extremely reliable but more modest discounts, making it ideal for shoppers who value consistency and simplicity over hunting for deep discounts.

3. ForeverLux: The premium discount leader

Rounding out the top three with 262 promotional codes in the past two years, ForeverLux stands out for offering the deepest discounts among leading brands:

Higher average discounts: Their most common promotion is "21% Off Storewide" (60 instances), followed by "25% Off Storewide" with minimum order requirements

More promotional diversity: 77.86% storewide codes and 18.32% item-specific promotions, offering a wider variety of savings opportunities

Premium discount thresholds: Frequently offers 25% off with minimum purchase requirements ($150-$300)

Multiple promotional structures: Uses various promotional formats including straight discounts, minimum order thresholds, and select item promotions

Winter peak activity: February and March are their most promotional months, both with 15 codes in 2024

ForeverLux provides the highest average discount percentages among the top three brands, making it particularly valuable for larger purchases where their 25% discounts with minimum order requirements offer substantial savings.

How the beauty industry has changed

The beauty industry has dramatically increased its promotional activity over the past eight years, with profound implications for consumer shopping strategy:

Beauty promo codes by year (2017-2025)

Year | Number of promo codes | Year-over-year Change |

2017 | 2,819 | Baseline |

2018 | 4,575 | +62.3% |

2019 | 6,223 | +36.0% |

2020 | 9,778 | +57.1% |

2021 | 12,035 | +23.1% |

2022 | 8,206 | -31.8% |

2023 | 9,964 | +21.4% |

2024 | 11,384 | +14.3% |

2025 (partial) | 2,500 | On pace with 2024 |

This data reveals three distinct phases in beauty industry promotional strategy:

Pre-pandemic growth (2017-2019): Steady expansion of promotional activity, with total industry codes more than doubling over two years.

Pandemic peak (2020-2021): Extraordinary acceleration during retail disruption, reaching an all-time high of 12,035 codes in 2021.

Post-pandemic stabilization (2022-2025): Initial correction in 2022 followed by renewed growth, with 2024 approaching the pandemic-era peak.

The 2025 partial data (through March) suggests the industry is maintaining the elevated promotional volume seen in 2024, with projections indicating another year exceeding 10,000 total promotional codes.

Makeup promo codes month-by-month analysis

Let's examine monthly patterns based on historical data from 2013-2025, with particular attention to recent trends:

Monthly promotion trends (past years)

Our analysis of month-by-month promotional volume reveals distinct seasonal patterns in the beauty industry:

Month | Historical average | Top promotional years | 2025 projected |

January | 5,330 | 2021, 2025, 2024 | Strong (986 so far) |

February | 5,297 | 2021, 2024, 2025 | Strong (748 so far) |

March | 5,579 | 2021, 2024, 2023 | Strong (766 so far) |

April | 4,923 | 2021, 2024, 2022 | Strong (projected) |

May | 5,620 | 2021, 2024, 2023 | Strong (projected) |

June | 5,785 | 2021, 2024, 2023 | Strong (projected) |

July | 5,970 | 2021, 2024, 2020 | Strong (projected) |

August | 5,979 | 2020, 2024, 2023 | Strong (projected) |

September | 5,086 | 2024, 2023, 2020 | Strong (projected) |

October | 5,710 | 2024, 2020, 2023 | Strong (projected) |

November | 6,838 | 2020, 2021, 2024 | Strong (projected) |

December | 6,133 | 2020, 2021, 2022 | Strong (projected) |

Monthly promo code volume in 2024

Month | Number of promo codes (2024) |

January | 791 |

February | 957 |

March | 922 |

April | 1,043 |

May | 945 |

June | 960 |

July | 1,043 |

August | 975 |

September | 894 |

October | 1,037 |

November | 1,008 |

December | 812 |

Several key insights emerge from this monthly analysis:

Holiday season dominance: November (6,838 total codes) and December (6,133 total codes) consistently show the highest promotional volume, reflecting the importance of holiday shopping.

Summer promotional strength: The June-August period maintains strong promotional activity, likely targeting vacation and seasonal skincare needs.

Early-year opportunity: January has shown particularly strong activity in 2025 (986 codes so far), continuing a trend of robust early-year promotions.

Post-pandemic patterns: While 2020-2021 represented peak promotional activity across most months, 2024-2025 data shows a return to strong promotional volume without reaching pandemic extremes.

2025 strong start: The first quarter of 2025 shows robust promotional activity, suggesting the year will maintain or exceed 2024's elevated promotional volume.

Maximizing your skincare savings in 2025

Based on our data analysis, here are the most effective strategies for maximizing your savings with the top skincare brands in 2025:

Target the right brands for your skincare needs

For natural skincare: Beauty by Earth leads with 164 recent codes

For comprehensive beauty with skincare: ULTA remains strong with 182 recent codes

For natural beauty products: iGoNatural leads all brands with 318 recent codes

For emerging skincare options: Hello Joyous (266 codes) and ForeverLux (262 codes) offer frequent promotions

Focus on strategic timing

The data clearly shows timing matters significantly for skincare purchases:

Holiday shopping: November-December offers the highest promotional volume

Summer skincare season: June-August provides strong promotional opportunities, especially for sun care

January reset: Strong early-year promotions for post-holiday skincare replenishment

Leverage promotional type differences

Different brands favor different promotional approaches:

Beauty by Earth: Focuses on storewide promotions (68% of codes)

iGoNatural: Leads in item-specific deep discounts (47% of codes)

ULTA: Balances storewide (42%) and gift-with-purchase (32%) promotions

The Ordinary: Rarely discounts individual products but offers frequent bundle deals

Monitor digital-native skincare brands

The significant increase in promotional activity from smaller skincare-focused brands represents an opportunity for substantial savings. While brands like Beauty by Earth may not have the name recognition of industry giants, they consistently offer more aggressive discounting on their skincare products.

Conclusion: Top skincare brands

Our analysis reveals a clear transformation in the skincare promotional landscape. While established beauty retailers still dominate all-time promotional rankings, today's top skincare brands for coupons are predominantly digital-native companies focusing on specific skincare niches.

iGoNatural leads overall promotional frequency with 318 codes in the past two years, while Beauty by Earth emerges as the top dedicated skincare brand with 164 codes. ULTA remains a consistent performer, appearing in both historical and recent rankings with 182 recent promotional codes.

For skincare enthusiasts seeking maximum savings in 2025, the data points to these key insights:

Follow the digital natives: iGoNatural, Beauty by Earth, and ForeverLux lead in promotional frequency

Don't ignore established players: ULTA and Boots maintain strong promotional calendars

Time purchases strategically: November-December and June-August offer highest promo volume

Focus on storewide promotions: They represent over 50% of all beauty promotional codes

Consider skincare specialists: Category-focused brands often offer deeper discounts within their niche

By targeting the right combination of brands and timing, skincare shoppers can significantly reduce their beauty spending while maintaining or expanding their skincare regimen.

How we get this data: Promo code data is sourced from ShopGraph, our proprietary knowledge system that continuously monitors 400,000+ stores. Every code is verified through our dual AI and community testing process.

Looking for the latest skincare brand promotions? Find verified beauty promo codes here

by Sean Fisher

AI Content Strategist · Demand.io

Sean Fisher is an AI Content Strategist at Demand.io, where he leads content initiatives and develops an overarching AI content strategy. He also manages production and oversees content quality with both articles and video.

Prior to joining Demand.io in September 2024, Sean served as a Junior Editor at GOBankingRates, where he pioneered the company's AI content program. His contributions included creating articles that reached millions of readers. Before that, he was a Copy Editor/Proofreader at WebMD, where he edited digital advertisements and medical articles. His work at WebMD provided him with a foundation in a detail-oriented, regulated field.

Sean holds a Bachelor's degree in Film and Media Studies with a minor in English from the University of California, Santa Barbara, and an Associate's degree in English from Orange Coast College.